Premise – Stockholder Benefit

During this COVID-19 social distancing, I’ve had time to reflect on travel-related stories, and wanted to plan for a future trip. I had such a blast on Norwegian Cruise Line last year on the Norwegian Bliss that I thought hey, why not try to score another one later this year after all this crazy goes away? During my research last year I found that NCL has a Shareholder Benefit – much like all the other cruise lines, where owning shares of the parent company grants you onboard credit (OBC) for use on the ship! I was able to do that last year, buying in for $55 and selling (much later) for $57 a share, netting $200 profit as well as $100 OBC.

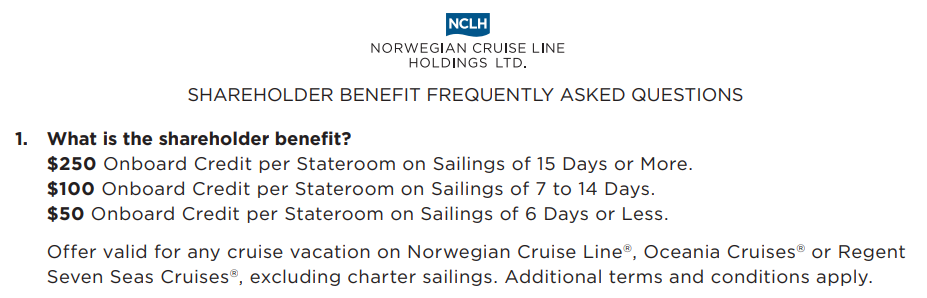

Stockholder Benefit Details

Per the NCL site – the shareholder benefit is for those who purchase 100 or more shares of NCL stock, submit the forms at least 15 days prior to sailing, and limited to one per cabin/stateroom. It was easy to do – simply show proof via any brokerage that you have. The value is below – $50 for 6 days or less, $100 for 7-14 days, and $250 for 15+ day cruises, usable for anything on board (hence, onboard credit). I use Robinhood – sign up here to get a free stock, worth up to $170 or more!

My Investment – 300 Shares NCLH @ $7.50 – $2,250

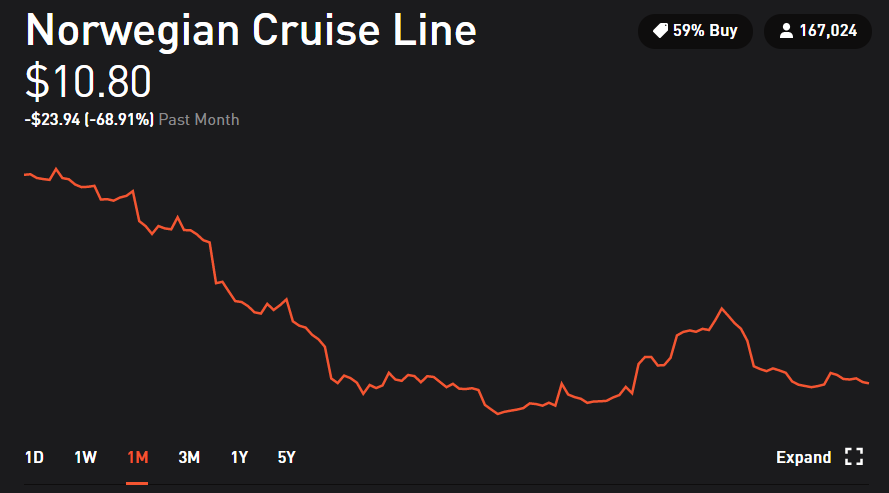

I put in more money into my Robinhood account a few weeks back, and snapped up 300 shares at $7.50, totaling $2,250, on March 19th. Assuming COVID lasts a few months, with the crash in oil prices, and an assumption of a return to some sort of normalcy, we should see the shares bounce back, maybe even back to their $50-60 pre-COVID prices. That would be phenomenal, as I’ve never really had anything that increased that far in value. Of course, in the week and a half since that purchase, the shares have gone up as high as nearly $20 and now retreated back to $11. Perhaps I’ll buy Royal Caribbean as well in case one of my many free cruise possibilities pans out and I use them instead.

Thoughts

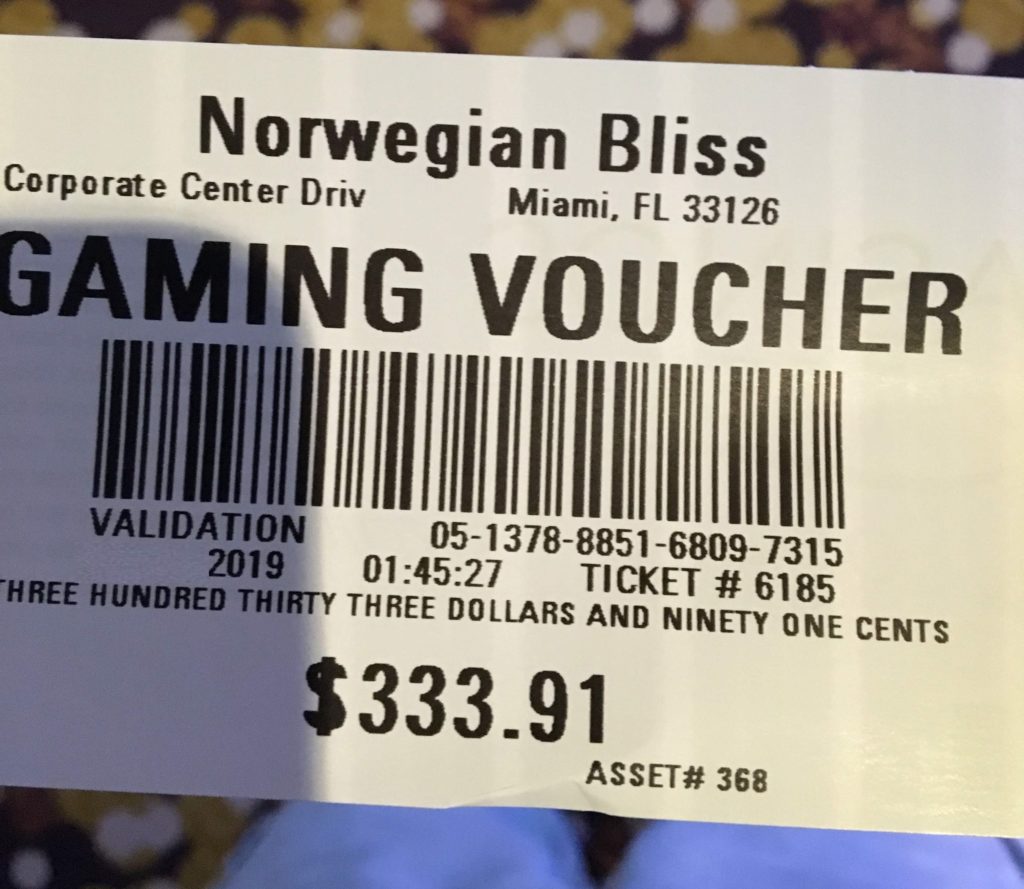

I haven’t decided if I’m going to sell 100 of the shares at $22.50, recouping my investment, or hold it all and hope it all rebounds. However, I only need 100 to generate the OBC for any future NCL cruises. Combine that with either Total Rewards promotions (20% off any room with Diamond Status) or MyVegas (where you can earn free NCL cruises) it’s a no brainer. Plus, I already know that the Norwegian Bliss has the requisite games that I need. Last time, we netted $600+ profit in the one week, and walked something like 20-25K steps per day – mostly in the ship’s smoke-free casino!

Featured Image is of the NCL Encore from Pixabay, the newest ship! If you’re interested in investing for free, without trading fees of any kind, sign up with Robinhood through my link and get a free stock! Disclaimer: This post may contain affiliate links which, should you click through and/or make a purchase, grant me a commission. Also, I only post in the best interest of my readers. Lastly, thank you for supporting my blog and my travels.

What do you think of my writing? Have any questions? Let me know in the comments, or reach me directly at TheHotelion@gmail.com! Like my posts? See more here, on TravelUpdate! Follow me on Facebook (The Hotelion) or on Twitter and Instagram: @TheHotelion

Many of these shareholder promo benefits have changed in recent years and can’t be stacked with other deals most of the time. Sometimes they can but not always. I like all the cruise lines but if you are just looking to buy stock in one of the big three. NCL doesn’t usually pay dividends where CCL and RCL usually do pay dividends. So in my none financial expert but being a shareholder and travel agent I personally thing, to me, that CCL and RCL are a better long term investment.

That’s totally fair – I’m a bit sad about that but I’m trying for a comp’d RCL trip later in the year – too bad can’t combine with Mlife / Myvegas / Shareholder OBC. I was able to stack NCL Stock & Total Rewards Discount, but not with a comped trip I guess.