As a long time Hilton loyalist, I’m disappointed but not surprised to see Hilton’s latest rug pull. What stinks the most about this particular move is that, similar to previous devaluations, they are sudden, without any prior intimation or announcements. Looking at the way Hilton’s points prices are heading, do the recent devaluations mean that the Hilton Aspire Card suddenly becomes the only viable option for those looking to book aspirational Hilton properties?

Singapore Airlines hikes premium cabin prices to 112,500+ miles one way, launches access awards

Hilton Stealth Devaluation

A quick glance at Reddit and some prominent travel blogs – and you’ll find what’s going on with Hilton. In my opinion, these are just sudden and in often cases, massive increases in prices overnight.

- Waldorf Astoria Cabo – From 190k points to 250k points/night

- Conrad Tokyo – From 100k points to 130k points/night

- Roku Kyoto – From 120k points to 140k points/night

- Conrad Singapore Marina Bay – From 70k points to 90k points/night

- Conrad Hong Kong – From 70k points to 85k points/night

- Waldorf Astoria Maldives now a massive 250k points/night

- Conrad Maldives Rangali Island now up from 130k to 180k points/night

- Waldorf Astoria Amsterdam – From 120k to 150k/points/night

- Waldorf Astoria Seychelles – From 150k to 200k points/night

- Waldorf Astoria Grand Wailer – From 120k to 160k points/night

Why the Aspire Card becomes more valuable

So, the next time American Express comes out with limited time offers on their cards, we’ll need to draw a distinction between points offers v/s free night certificate offers. A 150k offer? A 180k offer? If you’re looking to redeem for an aspirational stay, then forget it, you’d barely get a night in most cases, given the recent devaluations.

What Aspire Brings to the table

So why does the Hilton Aspire stand out then? With co-branded Hilton credit cards, you only have a couple of cards that offer free night certificates. Every now and then, Amex does come up with welcome bonuses that offer free night certificates.

In contrast, the Hilton Aspire Card gives you a free night certificate each year for simply keeping the card. Yes, you do get a free night certificate with the Hilton Surpass Card as well, but you need to spend $15,000 in a calendar year to earn that certificate. Also, unlike Hyatt’s and Marriott’s certificates, Hilton certificates don’t have any category or points restrictions. In essence, you can book a Hilton property using a certificate as long as a standard room is available at that particular property.

The Hilton Aspire card gives you one free certificate upon approval and then another when you renew the card each year. Let’s say you already have the Hilton Surpass and you get an offer to upgrade to the Aspire. It’s better to skip that and apply for the Hilton Aspire separately. That way you can now generate two free night certificates each year:

- One after you spend $15,000 on the Hilton Surpass Card

- Another each year for simply keeping the Hilton Aspire Card open

In short, if you want a shot at booking free nights at aspirational properties in the Hilton Honors program, then you just cannot do without the Hilton Aspire Card. Else, the points prices are just way too prohibitive and make it unaffordable for most people.

The Pundit’s Mantra

Ultimately, one can understand that a hotel chain like Hilton changing prices based on their business requirements. There’s a whole different dynamic at play between the hotel owners and the loyalty program. However, as someone who has been loyal to the chain for over a decade, what really stinks is how surreptitiously these devaluations are done. There’s one thing to not announce well in advance. It’s another thing to not announce at all. We know about these devaluations only because some eagle eyed reader, Reddit poster or blogger spotted it while making a booking.

How does this recent devaluation change your strategy with Hilton Honors bookings going forward? Tell us in the comments section.

___________________________________________________________________________________________________________________

Have an interesting travel story? Subscribe to my podcast and join the conversation

___________________________________________________________________________________________________________________

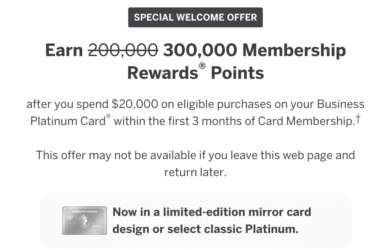

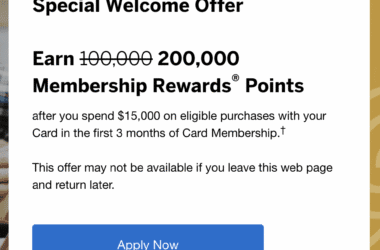

New Credit Card Offers

Chase Sapphire Cards

- Earn 125,000 Chase Ultimate Rewards points with the Chase Sapphire Reserve Card

- Earn 200,000 Chase Ultimate Rewards points with the Chase Sapphire Reserve Card for Business

Co-branded Delta SkyMiles cards

- No annual fee for the first year, earn 80,000 bonus miles with the Delta SkyMiles Gold American Express Card

- Earn 90,000 bonus miles with the Delta SkyMiles Platinum American Express Card

- Earn 125,000 bonus miles with the Delta SkyMiles Reserve American Express Card

- No fee for the first year, earn 90,000 bonus miles with the Delta SkyMiles Gold Business American Express Card

- Earn 100,000 bonus miles with the Delta SkyMiles Platinum Business American Express Card

- Earn 110,000 bonus miles with the Delta SkyMiles Reserve Business American Express Card

Co-branded Marriott Credit Cards

- Earn 185,000 Marriott Bonvoy bonus points with the Amex Marriott Bonvoy Brilliant Card

- Earn 155,000 Marriott Bonvoy bonus points with the Amex Marriott Bonvoy Bevy Card

- 125,000 Marriott Bonvoy points offer with the Marriott Bonvoy Business Card

___________________________________________________________________________________________________________________

Never miss out on the deals, news and travel industry trends. Like us on Facebook, follow us on Instagram and Twitter to keep getting the latest content!

Based on the arguments in your article, it’s pretty clear they went full MAGA.

It’s best for businesses not to jump into the political fray, but oh well.