American Express offers a ton of great benefits on many of their premium credit card products. However, not all benefits are created the same. The airline fee credit benefit, on the face of it, sounds like a simple credit that you’d get when you book a flight ticket. However, Amex only offers these credits on what it deems as incidental purchases on qualifying US based airlines. As usual, at the start of the new year, I took stock of which cards in my wallet have the benefit and decided to use up the credits right out of the gate.

AIRLINE FEE CREDITS FOR 2023

I have one Business Platinum Card and one Schwab Platinum card. Thanks to the changes made recently, I don’t have to go through this process on my Hilton Aspire card. I really like the new credit on the Hilton Aspire Card since it’s just a simple credit for buy airline tickets.

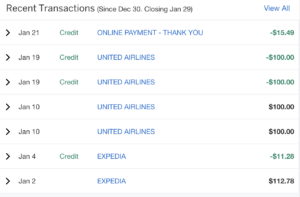

After looking up data points on Flyertalk, I decided to once again choose United airlines as my option for these credits. I headed over to United and started making purchases on United’s Travel Bank.

I selected the credits and then waited for about 24 hours. After 24 hours, I started loading my United Travel Bank in increments of $100.

THE PUNDIT’S MANTRA

Over the last five years or so, this has been a lucrative method for using up my airline fee credit benefit. Things can always change, so I always make a point to set a reminder early in the year to take care of all my airline fee credits. It gives me the option to use these funds to buy flight tickets in the future.

___________________________________________________________________________________________________________________

Never miss out on the deals, news and travel industry trends. Like us on Facebook, follow us on Instagram and Twitter to keep getting the latest content!