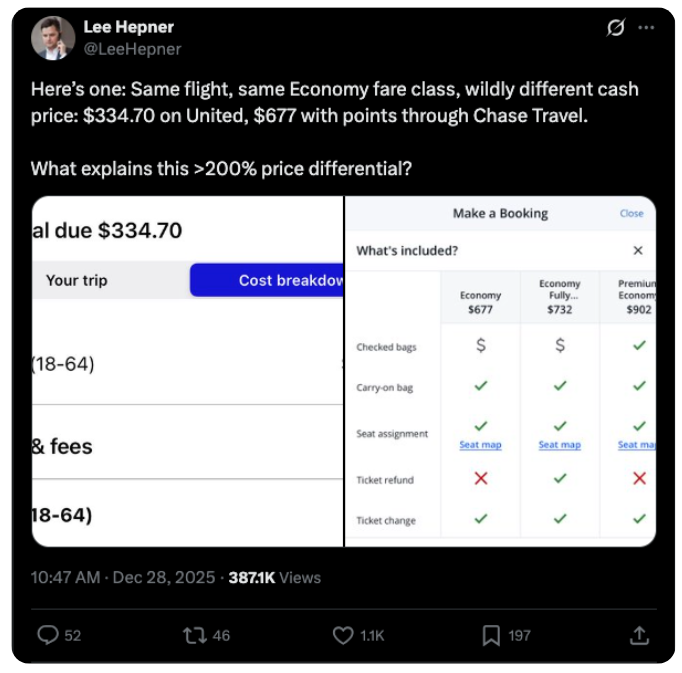

If you’ve spent some time on X (formerly Twitter) recently, you may have seen a series of posts calling out what appear to be wildly inflated airfares on credit card travel portals.

The user included two screenshots. One showed the cost breakdown of a flight when booking via United.com. The other showed pricing for what was allegedly the same itinerary but when booked via Chase Travel. It showed (according to the user) the same flight, the same airline, the same cabin. Yet, it was hundreds of dollars more expensive when booked through Chase Travel compared to booking directly with the airline.

At face value, this doesn’t look great. For premium cardholders paying up to $895 in annual fees, the implication that their bank’s travel portal is quietly padding prices is enough to spark outrage.

But while the frustration is real, the conclusion many people are jumping to is not.

In this post, we’ll explain what is actually happening behind the scenes when those price discrepancies appear, why they are becoming more common, and how travelers can navigate these discrepancies.

TL;DR: Credit card travel portals like Chase Travel and Amex Travel are online travel agencies, which means they do not always have access to every fare an airline sells. When a portal can’t access a specific fare (or chooses not to display it), it will show the next best available option, even if it’s more expensive.

That’s why travelers sometimes see a higher price for what looks like the “same flight.” In most cases, it comes down to fare code differences, limited basic economy availability, and the industry’s ongoing transition from legacy GDS ticketing to newer NDC distribution.

As Seen on X: The Same Ticket with a 102% Markup

As mentioned in the introduction, a user on X/Twitter recently shared two screenshots that purportedly showed the same itinerary available at widely different prices depending on where it was booked. In this case, the user alleges that Chase Travel was marking up the cost of the itinerary by 102%.

The user is a California-based lawyer practicing antitrust law. That said, these posts come from one of the more informed consumers on the social media platform.

The framing was simple and powerful: same flight, same fare class, more than double the price through a credit card portal. The implication was that portals are intentionally inflating prices. Unsurprisingly, other X/Twitter users reported similar instances of higher fares on travel portals.

One user hypothesized that “[Chase Travel] is charging price-insensitive customers who are spending points they earned from work travel, which cross-subsidizes leisure travel…” Another user shared their take posting that “Chase travel is almost always more expensive than booking directly. Why? Probably because they think you’re willing to pay more when booking through Chase.”

These are compelling takes and it builds an equally compelling narrative: “These people are already paying hundreds of dollars for a premium travel rewards credit card so, let’s mark up their airfare on our travel portals.” While compelling, it’s also incomplete.

To understand why it’s not uncommon to see higher fares on a bank’s travel portal compared to booking direct with the airline, we need to step back and look at how airline tickets are sold.

The Complex World of Airline Retailing

Airfare pricing and distribution is complex, to say the least. There is no one single market or single price when it comes to airfare. It is a fragmented, multi-layered distribution ecosystem shaped by decades of legacy technology and evolving standards.

What looks like “the same ticket” to a traveler is often not the same ticket at all. Peel back the layers of a ticket and you’ll find that how it was filed and distributed across booking channels is completely different from another ticket that looks identical.

How Airlines Sell Tickets

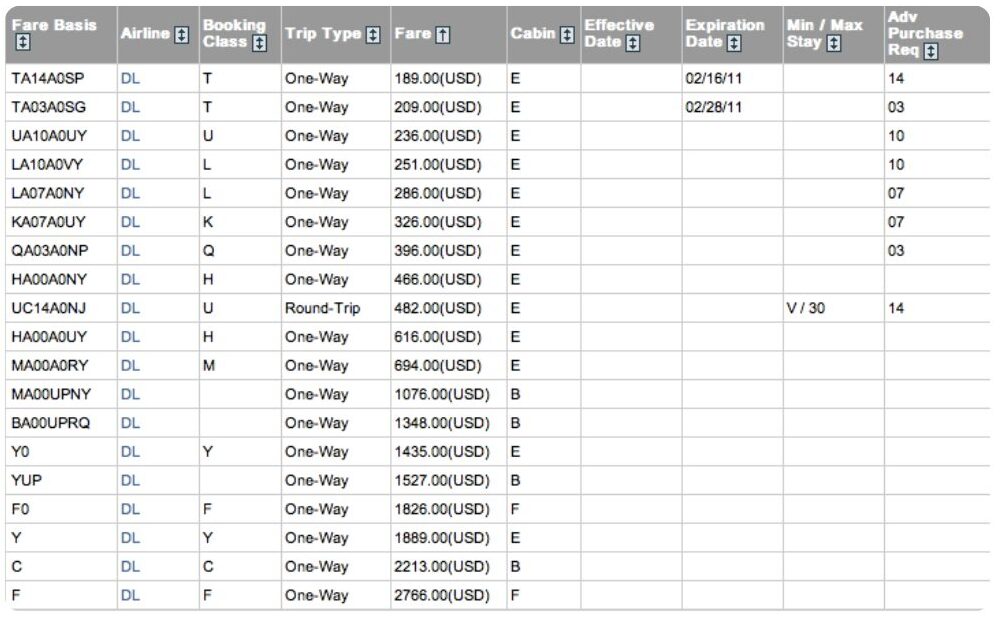

The foundation of airline pricing is a centralized fare filing system operated by the Airline Tariff Publishing Company. Airlines publish thousands of fares into this system, each with a fare basis code that defines its price, rules, eligibility, and availability.

Once fares are filed, they are distributed to various sales channels. In addition to an airline’s website, fares can be distributed to global distribution systems (GDS), online travel agencies (OTAs), travel management companies (TMCs), consolidators, tour operations, and of course, credit card travel portals.

One of the keys in understanding why fare discrepancies exist is that not all fares are distributed to the same channels. One fare might reach nearly all channels while another might be available exclusively via an airline’s own website or mobile app.

GDS vs. NDC: Legacy Technology vs. Modern Retailing

For decades, airline distribution relied on Global Distribution Systems (GDS). These systems use an older messaging standard known as EDIFACT. They are reliable, widely adopted, and deeply entrenched in the world of airline sales. However, as airline sales have evolved over the past few decades, they’ve also become more limited.

EDIFACT-based systems require fares to be filed in discrete fare “buckets.” If an airline wants to sell a seat for $200 based on real-time demand but only has buckets at $180 and $220, the system must round up. That’s just one of the limitations of this legacy system.

Enter New Distribution Capabilities or NDC for short. NDC is an XML-based standard promoted by IATA that allows airlines to price more dynamically, bundle ancillaries, and offer channel-specific pricing. NDC is how airlines increasingly sell their cheapest and most flexible fares.

The industry is currently in a transition between these two models. That transition has been tedious at times, and with both technologies still live, it’s one of the reasons travelers can see price discrepancies.

Fare Codes Matter More Than Cabin Labels

When a portal and an airline both display “Economy,” that does not mean they are showing the same fare. As many frequent flyers already know, under the “Economy” label exists upwards of a dozen fare codes each representing a different fare for what, on the surface, appears to be the same ticket in economy class.

Basic economy, main cabin, and economy class are marketing labels layered on top of fare basis codes. Two tickets can be on the same flight, in the same cabin, and still have different rules, different eligibility, and different prices.

The same applies across all cabins of service, not just in economy. For example, an airline typically has around four fare codes for business class.

As previously mentioned, not all fares are distributed to the same channels. So, for example, if a specific portal cannot access (or even limits) a particular fare code, it will default to the next best available option. In some cases, this next best option could be significantly more expensive.

Public Fares vs. Private Fares

Let’s add in one final layer in our airline retailing crash course: public versus private fares. When a fare is filed, it can be marked as either public or private. Public fares are broadly available across booking channels. Private fares, however, are restricted and are available only to specific agencies, corporate clients, or select channels.

Airlines may also negotiate private fares with select partners. One of these partners is credit card portals. An example of private fares with which many readers may be familiar are the discounted premium cabin fares available through American Express’ International Airline Program. However, these negotiated private fares are not universal, with Amex’s IAP somewhat of an outlier.

So, what does all of this have to do with the 102% markup one user shared on social media? To get to the final answer, we also have to take a closer look at what travel portals like Chase Travel really are in the world of airline retailing.

More from TravelUpdate: What Are Admirals Club Partner Lounges and How Can You Access Them?

How Credit Card Travel Portals Work

Despite the branding, Chase Travel, American Express Travel, and Capital One Travel are not magical platforms with access to secret inventory. Though some programs do occasionally get access to preferred fares, these are not the norm. These programs, at their core, are Online Travel Agencies (OTAs).

If you’re not familiar with OTAs, they are a digital platform that acts as a sort of middleman, allowing you to search for, compare, and book travel services like flights, hotels, and car rentals from many different companies all in one place. Some of the most well-known OTAs include Expedia, Booking.com, Orbitz, and Priceline.

Each of the major credit card OTAs whether it’s Chase Travel or Capital One Travel operate on a specific backend architecture.

But ultimately, none of these portals have access to every fare an airline sells. And this is what leads to pricing discrepancies like the example from social media. In short, these credit card travel portals are just one channel in a complex retailing ecosystem and can only show users the fares to which they have access.

Why Credit Card Portal Prices Are Often Higher (and Sometimes Lower)

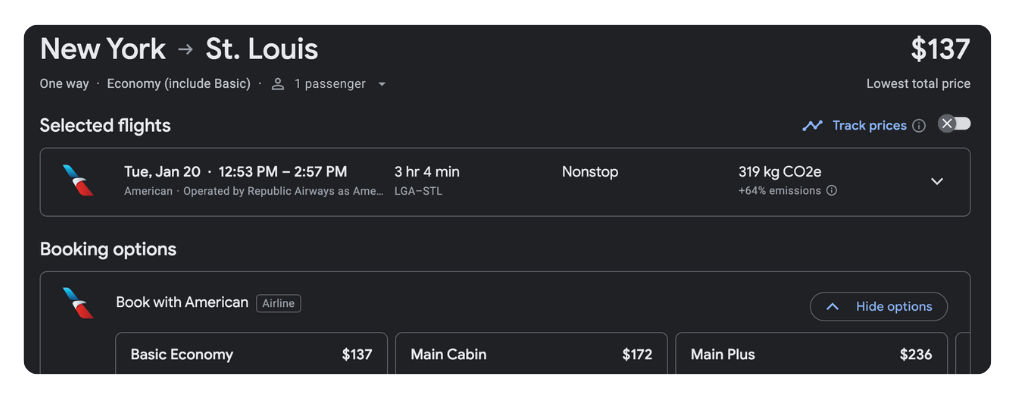

One of the most common reasons you won’t see the lowest fare on Chase Travel, Amex Travel, or other credit card travel portals is that many either do not have access to or do not offer the ability to book basic economy fares.

When you use a tool like Google Flights, you will almost always see the lowest possible fare for a flight. This is because Google Flights is just an aggregator. It’s looking at nearly every fare across nearly every booking channel. This includes fares available exclusively when booking directly with an airline.

As airlines look to reduce distribution costs, they’ve been limiting which channels receive their basic economy fares. In many cases, airlines have made basic economy fares available only when a traveler books with them directly. So, you won’t see these fares anywhere else except for Google Flights and similar tools.

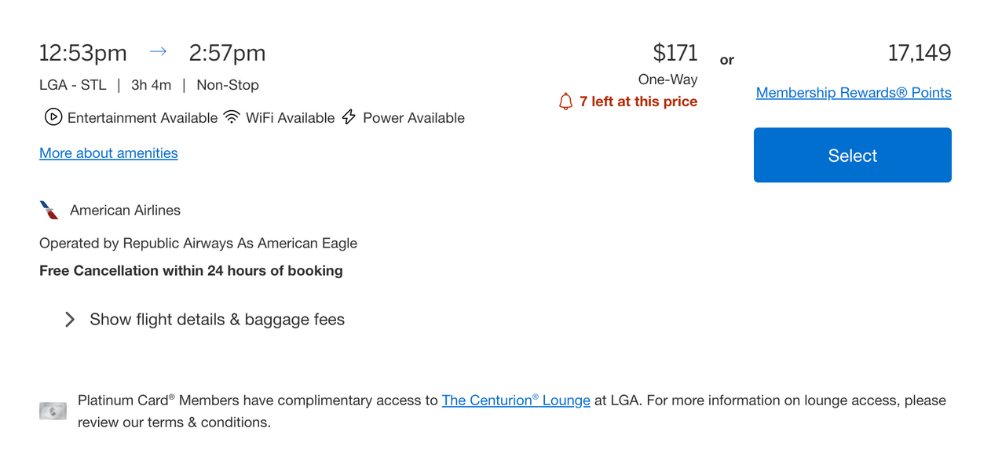

Here’s one example in which a fare appears higher on Amex Travel for the same ticket as a result of not being able to book basic economy fares on the platform:

In this example, I am seeing the best available standard main cabin fare via Amex Travel. Though, if I were to book via American Airlines’ website, I would also be able to book a basic economy fare.

At the same time, portals can sometimes be cheaper. Platinum Card Members can take advantage of the American Express International Airline Program. This cardholder benefit allows members to access discounted fares in premium cabins when booking with select airlines. American Express also offers select cardholders “Insider” fares in which commission fees are waived.

So, when we add in the fact that many travel portals don’t have access to or cannot handle the servicing associated with the cheapest possible fare, the reason for these pricing discrepancies becomes even more apparent. But what does this mean for you as a traveler?

|

Get through airport security faster with CLEAR+. Not sure if CLEAR is right for you? Sign-up now and receive 2 months of CLEAR+ at no charge.

|

Travel Portals and Best Practices for Travelers

You might be under the impression that you should never book airfare via a credit card travel portal or an online travel agency. It certainly sounds like you can’t possibly get the best deal so, why book via a third-party? There might be some truth to this if you are interested only in booking the absolute cheapest basic economy fare.

However, many travelers still like the ability to select a seat in advance, bring a carry-on at no additional charge, and have the option to earn points or miles. In that case, portals like Chase Travel can be great ways to book airfare.

Should You Ever Use a Travel Portal?

Yes, you can book using a travel portal, but only if it makes sense for a specific trip or itinerary. Again, if you’re someone who just wants a cheap basic economy fare, then you will probably have better luck booking directly with the airline. But if you’re looking for a standard economy fare or want to redeem points or miles earned with a credit card, travel portals can be a solid option.

Alternatives to Using a Travel Portal when Redeeming Points or Miles

In many cases, you won’t be receiving the maximum value from your credit card rewards when redeeming your rewards for airfare booked via a travel portal. That’s not to say that this is a terrible use of credit card rewards points or miles. Still, there are better ways to book flights using credit card rewards if your main goal is maximizing the value of these rewards.

Most credit card rewards programs allow members to transfer their points or miles to other loyalty programs. For example, American Express allows members to transfer Membership Rewards points to a number of partners including British Airways and Delta. Once you’ve transferred these points to an airline’s frequent flyer program, you can often find award redemptions that offer you better value per point than if you had booked direct using a card’s travel portal.

Related: Chase Sending Targeted Sapphire Reserve Upgrade Offers

The Bottom Line

The higher prices travelers sometimes see are the result of how airline fares are filed, distributed, and filtered across different sales channels. In many cases, the portal is showing the lowest fare it is technically able or willing to sell, even if a cheaper option exists on the airline’s own website.

What looks like the “same ticket” is often not the same fare at all. Differences in fare codes, basic economy availability, and legacy versus NDC technology can easily produce large pricing gaps, especially on international itineraries or highly price-sensitive routes. These discrepancies are features of the modern airline retailing system.

For travelers, the takeaway is simple: credit card portals are a great tool, but only in certain scenarios. They can offer real value, particularly when redeeming credit card points, booking standard fares, or leveraging card-specific benefits. But when price is the sole priority, especially for basic economy fares, booking directly with the airline will often yield the best result.

Do you book flights using credit card travel portals? Have you managed to find any deals via these portals or exclusive fare programs?

Up to 100,000 Bonus Points: You may be eligible for an elevated American Express welcome offer. Select new applicants can receive a welcome offer of up to 100,000 bonus Membership Rewards® points with the American Express® Gold Card after spending $6,000 in the first 6 months of opening an account. Terms and conditions apply and offer may only be available via select referral links.

Check Now to See If You Qualify for this Elevated Offer

*Referral offers vary by applicant and can change at any time. Terms, conditions, and $325 annual fee apply.