Covid 19 has wrecked markets and triggered a global depression. As travel remains at a standstill, we’re all looking forward to the day when things will open up. We’re seeing some initial signs, as certain countries grapple with initial steps of the process to reopen their countries. During such times, what’s the best possible travel credit strategy that you should pursue so that you can maximize when travel opens up?

Covid 19 Travel Slowdown

The question many are asking currently is about how they can best prepare to maximize points earning so that they can have enough points to travel once travel reopens after the Covid 19 threat subsides. As we all stay at home, here are a few key aspects that you need to pay attention.

1. Flexible Points Currencies

If you earn points in flexible currencies, they act as a good hedge against devaluation. For example, United recently devalued their miles. I’m glad I didn’t have any United miles. However, I have a pretty decent balance sitting in my Ultimate Rewards account. I’m not tied to a loyalty program and can now use the points at Hyatt or any of Chase’s other partners.

Also, as Covid 19 disrupts travel, we’re already seeing airlines file for bankruptcy. If you’re sitting on a ton of airline miles and the airline goes belly up, your miles may not survive as well.

2. Co-Branded Cards

Before Covid 19 upended the travel industry, we saw great bonuses on the co-branded Delta cards, up to 100,000 miles. As planes remain grounded and hotels remain largely shut, it will be a few months before we start seeing huge co-branded card bonuses.

However, banks have been selling a boatload of miles and points to their co-brand partners. We saw recent evidence of this with the massive Chase-Amex-Marriott and the Amex-Hilton points sales. Once travel reopens, banks will increase co-branded card bonuses in order to incentivize customers to fly and stay at a hotel again. If you hold a co-branded card, it might be better to keep it in the sock drawer for now and utilize your flexible points earning card for everyday spending instead.

3. Maximizing grocery spend bonuses

This week, I wrote about how the Amex Everyday cards can also be a fantastic option for grocery spend. Many issuers are already offering limited time bonuses for grocery spending. Amex almost revamped their entire portfolio to offer new benefits to customers. Similarly, Chase offered a ton of benefits in the form of extra points for grocery spend.

Grocery, both online and in store, will continue to be vital as a bonus category. If you don’t already, then it’s great to carry a dedicated card for grocery spending in your wallet. For example, I carry the Amex Gold card which gives me 4x per dollar spent at all US supermarkets.

4. Non-bonused Spending

As your spend moves largely online, you need to have one card that gives you a decent return on non-bonused spending. For example, I carry the Blue Business Plus credit card by American Express. I earn 2x Membership Rewards points for each dollar I spend. Also, the card gives me access to Amex’s lucrative transfer partners.

Again, your decision making will depend on which points ecosystem you want to be a part of. If you love Citi ThankYou points, then the Citi Double Cash Card may be a great option for you. You earn 2% cash back or 2x Thank You points per dollar you spend. Similarly, both the personal versions of the Chase Freedom Unlimited cards offer a decent recent. If you have the personal Chase Freedom Unlimited or the Ink Business Unlimited, you earn a flat 1.5% cash back or 1.5 Ultimate Rewards points for each dollar you spend.

5. Credits, Free Night Certificates and Benefits

For example, if you have the Hilton Aspire card, you may have the airline fee credit and the free night certificate to use each year. Thanks to Amex’s recent updates, you can easily meet the requirements this year. As you sit at home and take stock of your credit card portfolio, take a closer look at expiration dates for elite status, free night certificates and any other credits.

6. Shopping Portals

We’re in the middle of a global recession. As expected, companies are slashing marketing budgets. As a result, shopping portals aren’t offering very lucrative offers. However, for many online vendors, you can still get a decent 2-3x bonus for stuff you shop online anyway.

7. Buying Miles & Points

For a few, this may be a very good opportunity to buy points currencies at a cheaper price. However, we don’t really know yet when travel will fully reopen. In this post, I’ve discussed the pros and cons and why buying miles and points speculatively could be a trap.

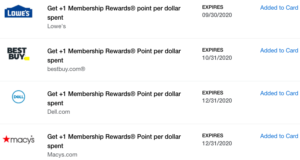

8. Amex & Chase Offers

Many people in this hobby carry at least one Amex or Chase card in their wallet. If you do, make sure that you periodically check for offers linked to your cards. Amex has been very proactive with these offers and has done a great job in tailoring them to current consumer spend patterns.

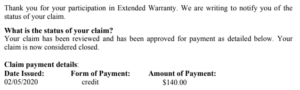

9. Purchase Protection, Return Protection and Extended Warranty

In previous posts, I’ve written about how I’ve saved hundreds of dollars due to Amex’s lucrative supplementary benefits. If you purchased something with your credit card and it broke down, now would be a good time to review your card benefits. Who knows, one of these benefits could possibly cover your repair costs?

In most cases, you can use these benefits without having to leave your home. I recently filed a claim online and Amex settled it in less than 24 hours!

The Pundit’s Mantra

As we wait for better co-brand card bonuses, flexible currencies will still rule the roost in the interim. This way, you can possibly hedge against an airline or hotel devaluation or even bankruptcy. Once travel reopens, airlines and hotels will up their co-brand bonuses to incentivize people to travel again.

In the meanwhile, this Covid 19 inflicted lockdown could be a good time to take stock of your travel credit card inventory. Also, make sure that you maximize points earning and pay as less as possible by utilizing shopping portals and offers.

As you stay at home during this Covid 19 crisis, which strategies are you using in order to maximize points earning? Tell us in the comments section.

___________________________________________________________________________________________________________________

This card is currently offering a 50,000 points bonus and a 0% Intro APR for 1 year, with a $0 annual fee!

___________________________________________________________________________________________________________________

Never miss out on the best miles/points deals. Like us on Facebook, follow us on Instagram and Twitter to keep getting the latest content!