The miles and points game ebbs and flows. Chase has always been a popular credit card issuer. It’s because of their impressive credit card portfolio and sign-up bonuses, be it the Chase Sapphire lineup or the Chase Ink Cards, or the impressive World of Hyatt credit card.

Last month, I wrote about how Chase has already made changes to the way it structure minimum spend requirements. They’re enforcing these changes on the co-branded cards as opposed to their own Ultimate Rewards points cards. In my opinion, it’s part of Chase’s two-pronged strategy. They’re cracking down on churners and looking for customers to stick with them in the long run.

5/24 Rule

Before we discuss what I call is Chase’s two pronged strategy, let’s start with the with dreaded 5/24 rule. Chase has expanded this rule to apply to almost all of their credit cards. Simply put, Chase will not approve you for a card if you’ve been approved for five or more credit cards in the last 24 months.

So how does Chase’s two pronged approach work?

Credit Cards earning Ultimate Rewards points

Chase has introduced another rule to its Sapphire cards in addition to the 5/24 rule. It’s the 1/48 rule for the Sapphire cards. What it means is that you can only earn the sign-up bonus once every 48 months.

Simply put, you cannot have more than one Sapphire card at a time. You can only get a Sapphire card and its bonus once every 48 months. Chase is a bit more lenient with the Freedom cards in their portfolio. You can earn the bonus every 24 months.

In effect, there’s a 24-48 month waiting period if you’re looking to churn cards. In addition, Chase has 5/24 in place. So they’re ensuring that if you’re looking to really hit Chase’s bonuses hard, you’ll get a Chase card once you drop under 5/24.

Co-branded Chase Credit Cards

If you take a look at the current offers on Chase’s co-branded credit cards, then the trend is pretty obvious.

Earn 25,000 Bonus Points after you spend $3,000 on purchases within the first 3 months of account opening. Plus, earn an additional 25,000 Bonus Points after you spend $6,000 total on purchases within the first 6 months of account opening.

Chase United MileagePlus Explorer card

Earn 40,000 Bonus Miles after you spend $2,000 on purchases in the first 3 months your account is open. Plus, earn an additional 10,000 Bonus Miles after you spend $5,000 total on purchases in the first 6 months your account is open.

British Airways Visa Signature Card

Earn 50,000 Bonus Avios after you spend $3,000 on purchases within the first 3 months of account opening. Plus earn an additional 50,000 Bonus Avios after you spend $20,000 total on purchases within your first year of account opening.

Earn 50,000 Bonus Avios after you spend $3,000 on purchases within the first 3 months of account opening. Plus earn an additional 50,000 Bonus Avios after you spend $20,000 total on purchases within your first year of account opening.

Co-branded Card Sign-up Bonuses

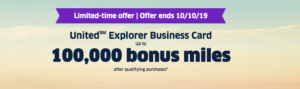

A few months back I’d written about how the Chase-United partnership was possibly on shaky grounds. A new offer popped up on the Chase United Explorer Business Card. The sign-up bonus is a whopping 100,000 United miles. However, the minimum spend to achieve the bonus is also a whopping total of $25,000.

Chase United Explorer Business Card

Earn 50,000 bonus miles after you spend $5,000 in purchases in the first 3 months your account is open. Earn an additional 50,000 bonus miles after you spend $25,000 total in purchases in the first 6 months your account is open.

The message here seems to be clear. You can get co-branded credit cards more often from Chase as compared to the Sapphire cards. However, be ready to spend a lot more in order to get those six-figure sign-up bonuses.

The Pundit’s Mantra

If you’re looking to hit Chase’s sign-up bonuses hard in order to churn, those days may be over, at least for now. Given the way Chase structures these bonuses, the trend is clear. What’s also evident is the business reason behind the decision. Chase wants you to get higher bonuses on their co-branded cards. It’s just that they want you to spend a lot, so that their co-brand partnerships are still lucrative and that their co-brand partners are also kept happy.

On the other hand, if you want Chase’s cards in the Ultimate Rewards portfolio, you can get them, but less often. If you want the Ink Preferred, you can get the bonus once every 24 months. If you want the Chase Sapphire Preferred or Reserve, then you’ll have to wait for 48 months.

So, if you’re still a churner who wants to churn Chase cards, here’s the deal. Be ready to wait for 24-48 months on an average. Be ready to spend around $5,000 in 3 months for most of the Chase Ultimate Rewards points card and a total of $20,000-$25,000 in a period of six months to get the six figure sign-up bonuses on the co-branded credit cards. Oh yeah, and yes, 5/24 is still enforced. This seems to be the new normal.

What do you think about these moves by Chase? Are these rules adversely changing your credit card application strategy? Let us know in the comments section.

Never miss out on the best miles/points deals. Like us on Facebook, follow us on Instagram and Twitter to keep getting the latest content!

Aren’t IHG’s exempt?

Yes I am in the clear to reapply, how long after I cancel the Sapphire card should I wait to reapply?

That’s great. I recently did the same after falling under 2/48 and I applied for the 100k Chase Sapphire Preferred Offer. Instead of canceling, I downgraded my existing card to a Freedom card. I’d say wait for a week for things to get updated in Chase’s systems before applying for it again.

This article is dated just a couple months ago but there is really no new info here. 5/24 has been around forever; the ‘one sapphire’ rule is at least a year old; and I don’t really even understand your point about co-branded cards. No offense but this just feels like clickbait, especially given the affiliate links

Thanks for your comment. I’d request you to refer to the very first line of this article. I do not have any relationships with affiliate marketing companies, nor do I receive any sort of compensation. All the links in the co-branded section are directly to public offers on the Chase website.

then why are some of the links ‘referyourchasecard.com’?

That’s a personal referral link, which is different from an affiliate link.

The Chase cards are simply too good for everyday spend to forgo having them for several years in order (maybe) to get another sign-up bonus. The opportunity cost is just too great. These are the cards to keep in your wallet.

One of my favorites is the Hyatt card which you can use to spend your way to elite status. Also, the annual free night more than helps with nullifying the annual fee.