Chase rules the roost when it comes to miles and points credit cards. The Chase Credit Card portfolio contains an impressive collection of credit cards. Chase created massive buzz with the lucrative 100,000 Ultimate Rewards points launch offer with the Chase Sapphire Reserve. However, they’ve always struggled with one particular co-branded credit card.

Chase Starbucks Credit Card

This post isn’t really whether about whether you like or dislike the coffee at Starbucks. As someone who frequently buys coffee at Starbucks , I tried to find a compelling reason to get this card but I couldn’t. Let’s analyze some of the benefits of this card.

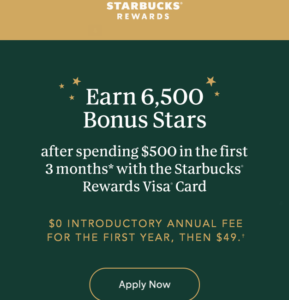

Sign-up Bonus

The card initially started with a 2,500 Starbucks Stars bonus after you spend $500 in the first 3 months. The card currently offers a sign-up bonus of 6,500 bonus Stars after you spend $500 in the first 3 months. Starbucks made changes to its rewards program in April. As opposed to a fixed redemption value, your redemption value is now tied to the kind of purchase you make at Starbucks.

Here’s the new redemption structure:

| Number of Stars Needed | Item on the menu that can be redeemed |

| 25 Stars | An extra espresso shot, dairy substitute or a dash of your favorite syrup. |

| 50 Stars | Brewed hot coffee, bakery item or hot tea |

| 150 Stars | Handcrafted drink, hot breakfast or parfait |

| 200 Stars | Lunch sandwich, protein box or salad |

| 400 Stars | Select merchandise or at-home coffee |

The sweet spot for redemptions is primarily if you buy a lot of hot coffee and baked goods. With a 6,500 Stars sign up bonus, you can get 130 orders of free hot brewed coffee/tea or a bakery item. Unfortunately, Starbucks classifies their basic iced coffee as a ‘handcrafted drink’. If you tend to drink a lot of iced coffee or cold brew as I do, then you’ll end up paying 3x the amount of Stars for a redemption.

If you’re a fan of sugar loaded Frappucinos, then you’re clearly out of luck. A single credit card sign up bonus would get you only 16 Frappucinos.

Earning Rates

Even before Starbucks changed their rewards program, the initial earning rates this card offered disappointed me. With this card, you earn 3 Stars per $1 spent at Starbucks stores. This is quite decent. However, here’s the bad part. The card earns only a paltry 1 Star for $2 you spend at grocery stores, transit and commuting and on internet, cable and phone services. The real kicker is the fact that the card only earns 1 Star per $4 spent on all other purchases.

Given the way the earning is structured, there’s obviously a higher earning rate at Starbucks like any co-branded card would offer. However, I was hoping for better earning ability on day to day purchases. Beyond the sign-up bonus, I like to hold on to cards in the long term and use them for everyday purchases as much as possible. If you’re looking to use this card for daily purchases, there are much better options of earning Starbucks Stars much quicker.

Starbucks Promotions

As someone who has been a member of the Starbucks rewards program, I’ve found this to be the fastest method to rack up Stars. Starbucks frequently sends both public and targeted promotions. These promotions usually involve making certain purchases at certain times in order to trigger a bonus of ‘Stars’. I’ve been able to attain gold status and earn thousands of Stars by leveraging these promotions.

If you visit Starbucks frequently, you can earn Stars a lot faster with these promotions instead of simply reloading and spending with a Starbucks co-branded card.

Chase 5/24 and Annual Fee

I was surprised at how quickly this card fell under 5/24 right after its launch. It seems like Chase didn’t want to open this card up to a lot of miles and points lover who would be over 5/24 and would try to ‘maximize’ the program. 🙂 The card also has a $49 annual fee. This way you can’t really do the ‘try before you buy’ thing with this card. However, Chase is sending targeted offers with a $0 introductory annual fee.

8 annual complimentary Barista Picks

I don’t find this benefit of much value. A true benefit is one that offers the customer with a choice and satisfies the customer’s need for a particular product. This seems to be primarily designed to get some feedback on upcoming drinks and food items.

In this case, the Baristas pick the items on offer. The Barista may pick and offer me a drink that’s of no interest to me. In that case, why would I find any value in this benefit?

Stars Expiration

Even if you rack up a lot of Starbucks Stars, they expire in 6 months after you earn. If you have a lot of Starbucks Stars, you cannot hoard them for too long and have to redeem them before they expire.

The Pundit’s Mantra

I’ve been able to consistently have a four figure Starbucks Stars balance, which I’ve earned by maximizing lucrative Starbucks promotions that I get almost on a bi-weekly basis. Even though Chase has targeted me with the no initial annual fee offer, I’m still not convinced about applying for this card. Beyond the sign-up bonus, I don’t see the earning rate and other benefits compelling enough in order to renew the card year after year.

Given that Chase enforces 5/24, I don’t intend to use a 5/24 slot by applying for this card. Besides that, I already earn 2x points per dollar that I spend at Starbucks, thanks to my Chase World of Hyatt Credit Card. The World of Hyatt Credit Card currently offers a sign-up bonus of 50,000 World of Hyatt points after you spend a total of $6,000 in the first 6 months of opening the card.

You can also use your Citi Prestige Card, the Amex Gold Card or the Chase Sapphire Reserve card in order to get 5x, 4x and 3x per dollar spent at Starbucks respectively.

What do you think about the Starbucks Credit card? Do you plan on getting the card if it comes without the annual fee? Let us know in the comments section.

Never miss out on the best miles/points deals. Like us on Facebook ,follow us on Instagram and Twitter to keep getting the latest content!