Yesterday, Chase revamped its Freedom Card portfolio as it relaunched their Freedom Unlimited and Freedom Flex cards. While the developments are indeed positive, how do they impact the Chase Sapphire portfolio? Given how lucrative how some of the no annual fee cards have now become, it could well be a matter of time before Chase improves earning rates on its Sapphire Cards. Why do I think so? Let’s have a look and compare Chase’s portfolio of Freedom and Sapphire Cards.

Chase Freedom v/s Sapphire Cards

We’re only going to compare the cards based on their earning rates. In terms of redemption values, we can’t really make a comparison, simply because you can only transfer points to Chase’s travel partners if you hold one of the Sapphire cards or the Ink Business Preferred. In short, if you only hold the Freedom cards, you can earn cash back but cannot transfer your points to airline or hotel partners.

| Card Name | Welcome Bonus | Annual Fee | Travel | Drug Stores | Dining | Quarterly Categories – Capped at $1,500) |

| Chase Freedom Flex | $200/20k Points | $0 | 1x | 3x/3% | 3x/3% | 5x/5% |

| Chase Freedom Unlimited | $200/20k Points | $0 | 1.5x | 3x/3% | 3x/3% | N/A |

| Chase Sapphire Preferred | 60k Points | $95 | 2x | 1x | 2x | N/A |

| Chase Sapphire Reserve | 50k Points | $550 | 3x | 1x | 3x | N/A |

Before we analyze the differences, there are a few key points worth noting:

- The Chase Freedom Flex Card and the Chase Freedom Unlimited Card will offer 5% cash back/5x points per dollar your spend when you purchase travel thru Chase’s Ultimate Rewards portal

- Conversely, you earn 2x and 3x points per dollar you spend for all travel with your Chase Sapphire Preferred and Reserve card respectively

Chase Sapphire Preferred – Two Card Combo

If you currently have the Chase Sapphire Preferred card and one of the Freedom cards, you’ll earn 1x more on dining and 2x more on drugstores with one of the Freedom cards. You’ll also earn 2x on all travel spend. You will pay a total of $95 for the two cards.

However, if you only hold the Chase Sapphire Preferred card and don’t carry any of the Freedom cards, you’ll be earning 1x less on dining compared to the new Freedom cards.

Chase Sapphire Reserve – Two Card Combo

If you currently carry the Chase Sapphire Reserve card and one of the Freedom cards, you’ll earn 2x more on drugstores and earn the same 3x on dining. You’ll also earn 3x on all travel spend. You’ll pay a total of $550 for the two cards.

However, if you only hold the Sapphire Reserve Card don’t carry any of the Freedom cards, you’ll miss out on the drugstore bonus.

Blurring the Lines

While the new changes are great, they blur the lines in terms of value proposition with regards to earning points. Card issuers offer products with different price points in order to cater to specific market segments. With these changes, there are certain overlaps between the Freedom and Sapphire cards, especially in the dining category.

Like many people, if you aren’t traveling much these days and not using lounges, then it makes sense to simply downgrade to the Chase Sapphire Preferred Card and get a Freedom card. In that way, you can continue to earn 3x on dining and drugstores but only pay $95 out of pocket annually.

The Pundit’s Mantra

In a subsequent post, I’ll highlight another reason why these changes could be imminent. Competing premium travel cards like the Citi Prestige (5x on dining) and the Amex Gold Card (4x on dining) already offer better earning rates than the Sapphire Reserve, which has a $550 annual fee.

How could Chase respond? Well, we could well see them up the earning rates on the Sapphire Cards in the dining category – 5x on the Reserve and 3x on the Sapphire. Chase could put the icing on the cake by adding groceries as a permanent bonus category on the Sapphire Cards, especially if they want to take cards like the Amex Gold Card (4x on groceries) head on.

What do you think about the changes to the Chase Freedom cards? What changes would you like to see to the Chase Sapphire Cards? Tell us in the comments section.

___________________________________________________________________________________________________________________

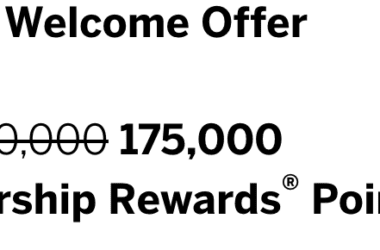

This travel credit card is one of my favorite hotel credit cards. You can earn a welcome bonus of 50,000 points when you apply for this card using the link below!

With this card, you’ll not only earn a free night each year when you renew the card, but If you pair it with this limited time offer, you’ll also earn 25% points back when you redeem your points until October 8, 2020.

___________________________________________________________________________________________________________________

Never miss out on the deals, analysis, news and travel industry trends. Like us on Facebook, follow us on Instagram and Twitter and get the latest content!

___________________________________________________________________________________________________________________

Disclosure: The Points Pundit receives NO compensation from credit card affiliate partnerships. Support the blog by applying for a card through my personal referral links. This article is meant for information purposes only and doesn’t constitute personal finance, health or investment advice. Please consult a licensed professional for advice pertaining to your situation