A few weeks back, I wrote about a very concerning recent trend in the travel credit card space. Issuers, primarily American Express, are increasing annual fees across the board, while adding largely meaningless credits that are difficult to use. Be that as it may, it has forced my hand to rethink my travel credit card strategy. However, there’s one card that keeps providing value year after year and I’m more than happy to pay the annual fee each year to renew it.

Chase Sapphire Preferred – A fantastic mid tier travel credit card

I’ve been pretty vocal about the stealth devaluation of the Amex Platinum card and the Amex Gold card. I picked these up when the annual fees were $450 and $95 respectively, only to be starting at annual fees of $695 and $250 as of today! However, while the Chase Sapphire Preferred is not a direct competitor to the Platinum Card, I think that Chase has done a great job in keeping the value of the card relevant for long time cardholders like me. Firstly, the annual fee has stayed steady at $95. Secondly, it offers a brilliant value proposition compared to the ‘new’ Amex Gold card, which is muddled with different credits and rebates.

Currently, you can earn a welcome bonus of 75,000 Ultimate Rewards points after you spend $4,000 in the first 3 months of card membership. The standard welcome bonus on this card is usually 60,000 points.

Click here for the 75,000 points offer

Earning Points

The great thing about the Sapphire Preferred is that you get great value on your everyday spend, especially if you’re like me and spend a lot travel and dining.

- 2x points for each dollar spent on travel

- 3x points for each dollar you spend on dining

- 5x points for each dollar you spend on travel booked trough Chase Travel

- 10% bonus points each year upon account anniversary based on annual spend

Now, the last one isn’t that great a benefit for me. However, Chase gives you another $50 when you book a hotel stay via Chase Travel. Since I book multiple hotel stays each year, I find this benefit very easy to use. Bear in mind though, this credit is applicable each anniversary year and not during each calendar year.

Additional Benefits

Chase offers a bit of Amex-y credits here as well. I don’t use any of these benefits, but it can be great for people who love ordering food or grocery via apps quite often.

- Complimentary Doordash and Caviar subscription

- 6 free months of Instacart+ and $15 in quarterly credits with Instacart

In addition, you also earn 5x points for each dollar you spend with Peleton and Lyft. In my case, I don’t quite value these benefits at face value, but they may be very valuable for others. In my case, I consider the bonus on travel and dining spend my bread and butter. Moreover, the $50 hotel credit is also pretty easy to use.

The Pundit’s Mantra

Now you may ask, what’s so great about this card? In my opinion, it just delivers value, following the KISS concept (you know what that means, right? 😉 ). It doesn’t try to be like the Amex Gold or anyone else. Just a simple annual fee and value on everyday spend. Also, you earn transferable points that you can transfer to Chase’s valuable transfer partners. You can transfer these points at a 1:1 ratio. Every now and then, Chase also runs transfer bonuses. I’ve derived great value from my Chase points by transferring them to United MileagePlus, World of Hyatt, Singapore Airlines KrisFlyer and Air Canada Aeroplan.

Also, you can get an easy 1.25 cents per point value in case you don’t want to transfer to Chase’s partners. In this case, you can redeem a 75,000 points bonus to the tune of $937 when you book via Chase Travel.

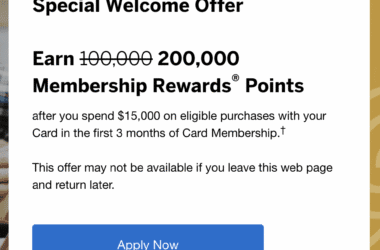

If you’re looking for a more premium travel credit card option, then the Chase Sapphire Reserve is a great option. The Chase Sapphire Reserve is also offering a limited time welcome bonus offer of 75,000 Ultimate Rewards points.

Apply Now for the 75,000 points offer

___________________________________________________________________________________________________________________

Never miss out on the deals, news and travel industry trends. Like us on Facebook, follow us on Instagram and Twitter to keep getting the latest content!