When everyone’s elite, nobody is. That’s a phrase that’s commonly thrown around in several conversations in our space. However, is there any truth to this claim? Firstly, let’s examine what elite status truly is. It’s preferential treatment from a brand over other customers for your loyalty. This loyalty may be due to frequent purchases or large volume purchases. However, what happens when loyalty programs make it very easy to earn tier elite status?

Loyalty Programs offering status via Credit Cards

We live in an era where two of the biggest hotel loyalty programs offer elite status with credit cards. With Hilton, you get automatic Diamond status, which is top tier elite status. Marriott Bonvoy, with the Bonvoy Brilliant card by Amex, gives you automatic Platinum elite status. While it may not be top tier, it’s still pretty decent.

However, what happens when hotel properties start posting signs like these?

Elite status is only valuable if the member is clearly receiving preferential treatment over other members who are non-elite. While nothing is guaranteed, an elite member who doesn’t get elite level perks delivered is more likely to complain than a non-elite member who doesn’t get anything.

Also Read: The Silent Devaluation of our favorite Loyalty Programs

It’s interesting that academic studies also talk about this particular principle. If you refer to the whole paper here, you’ll find that even Marriott Bonvoy is mentioned as one of the examples.

Compare Famous Footwear, which has only one elite tier (gold), with most hotels that have at least three tiers (e.g., Marriott Rewards offers silver, gold, and platinum) or Regent Cruise Line, which has five tiers (bronze, silver, gold, platinum, and titanium). While myriad factors will determine what hierarchical structure is optimal for any individual firm, our focus is on two basic charac- teristics that affect subjective impressions of status: (1) the number of tiers and (2) the relative size of each tier. These characteristics warrant attention as they constitute the critical determinants in the trade-off encountered when marketers decide how many customers to bestow with status. On one hand, a firm can make more customers feel special by adding elite tiers or increasing the size of any or all of the tiers or doing both. On the other hand, expanding the pool of elites can dilute the subjective perceptions of status among those customers who would qualify for status in a more restrictive scenario. Consider, for example, how Famous Footwear’s gold members’ sense of status might change if their number were doubled or if a silver tier were added.

Further, we explore how top-tier customers (e.g., gold) feel when a superordinate tier (e.g., platinum) is introduced above them. This is what happened when United reportedly invited some 18,000 high-revenue Mileage Plus fliers to be Global Service members, relegating its top-tier 1K fliers to de facto second-class status (Elliott 2007)

So, what happens when you walk in at a Marriott property as a Platinum elite thanks to your credit card, only to see that there are many people already checked in, holding a status above your tier?

Status is most commonly considered one’s position in society, which is driven in large part by specific status char- acteristics such as wealth, race, and occupation. Marketers recognize people’s desire for status and design loyalty pro- grams that capitalize on individuals’ desire to be recognized and feel superior to others.

The Pundit’s Mantra

Complimentary elite status via credit cards works great for banks and hotel loyalty programs to drive sign ups and engagement. However, the proof of the pudding lies in the eating. The rubber hits the road when the customer checks in at a property.

What is the experience like? Does the property do well enough to cater to the needs of each elite member, irrespective of how many elites are checked in? Or are the signs placed during check in to make sure that a member’s expectations are dialed down even before one completes check in.

Also, does a given property have enough resources and space available when multiple levels of elite tier guests are checked in at the same time? Given the pressure, there are bound to be elite customers who will be less happy than others.

What’s your take? Do you think getting complimentary status from hotel credit cards has diluted the value that you’re getting from your favorite hotel loyalty program? Tell us in the comments section.

___________________________________________________________________________________________________________________

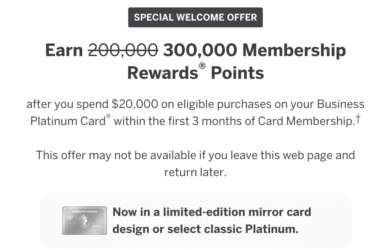

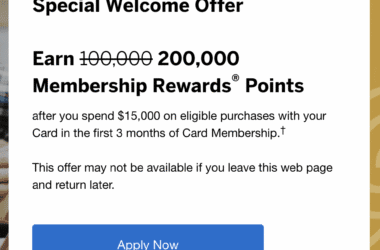

With these limited time offers by Amex, you can ear up to 175,000 points and 1 free night certificate from a single credit card welcome bonus

Click here to know more…

___________________________________________________________________________________________________________________

Never miss out on the deals, news and travel industry trends. Like us on Facebook, follow us on Instagram and Twitter to keep getting the latest content!

I tend to agree with your perspective. I’m now retired but traveled extensively for almost 40 years. Back in the day I was top level of 2 different airline programs in a year (by flying since way before earning any points or status w credit cards) and similarly was top in Marriott and Hilton. I earned the hotel status by staying 50-60 nights a year with each company. As a result I’m now Marriott lifetime Titanium, lifetime Platinum on AA and DL, lifetime Silver on UA and a 25 year Hilton Diamond member (still a few hundred thousand from lifetime Diamond). I really feel for people now that gain status via stays or logging 100 flights a year (or more). They are basically reduced to the same as someone with the right card (Hilton and Marriott) or someone that runs a lot through their AA, DL or UA card. Also, airlines and hotels are monetizing upgrades more so those aren’t as frequent.

My view is if I check in a hotel and they can do ANYTHING for me I’m grateful (even a better room position or late checkout). I can’t stand people that whine (at Hilton for example) “but I’m a Diamond”. Yeah you and 1/3 of the people in the hotel. Accept reality and move along. Also do agree I get much better treatment internationally. In both Europe and Asia I’ve gotten amazing suites as upgrades and basically treated like royalty. I guess due to caps on exchange fees there credit card holders don’t have the same benefits so not as many elites. BTW, that is what will happen in the US in the next 5 years as I truly believe there will be a cap on exchange fees and that will end the points/miles benefits associated with cards. Maybe we will be back to “butt in seat” miles and nights in hotels to actually earn status – that would be great IMHO.

I agree with the international travel part 100%. Over the last 12 months, I’ve stayed at properties in the UAE, India, Singapore, Malaysia and the Maldives and have almost always received an upgrade, in addition to the other published benefits. Free breakfast as a Diamond outside the US is one of the main reasons why I’m still sticking around with Hilton, since most of my travel is international.

The problem is not the credit cards. It’s that people like to travel where it is relatively close to them. So yeah, vacation in the USA, Canada, Mexico and Europe and expect to compete with every other elite. Be adventurous and have a bit more time, well in South America and Asia you won’t be competing with nearly as many elites and the programs not just deliver their advertised benefits but generally go above and beyond.

Each person’s travel style is different. As you pointed out, I have friends who only like to do road trips locally or do a short domestic trip within the US. We’re probably a small subset that loves doing more international travel than domestic.

Hotel loyalty programs never made sense; airlines actually own the planes that they fly – hotel brands don’t usually own the hotels. If credit card agreements can overcome actual airline loyalty, they can dominate actual hotel chain loyalty.

Loyalty programs make airlines and hotel chains a ton of money, so they’ll be around for sure, just that their value to elite members will be diluted, given the proliferation of elite members earning complimentary elite status via credit cards.