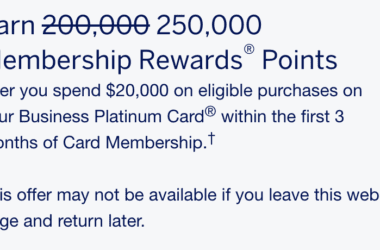

A few days back, I wrote about how I got outsized value from my Amex Platinum card. However, DDG posted this bit of news which is definitely a big blow if you own the Charles Schwab version of the Amex Platinum card.

What’s going on with this Amex Platinum card?

What’s so unique about the Charles Schwab version? Firstly, you have the ability to convert your Membership Rewards points into cash by depositing them into your Charles Schwab account. Before the previous devluation, you could convert your points into cash at a rate of 1.25 cents per point. In effect, for each chunk 10,000 Membership Rewards points you’d convert, you’d get $125.

Amex then devalued this benefit and reduced the ratio to 1.1 cents per point. With this latest update, you will be capped at a maximum of 1 million points at that 1.1 cents per point ratio. What’s worse is that after the 1 million points threshold is crossed, your conversion rate will dip 27% to a mere 0.8 cents per point. This change kicks in on October 1, 2024.

Important Note: Starting Oct 1, 2024, the rate for redeeming Membership Rewards points for deposits will change. Basic Card Members will be able to redeem Membership Rewards points for deposits to their eligible Schwab account at a rate of 10,000 points for a $110 deposit for up to 1,000,000 points, after which they may continue to redeem points at a rate of 10,000 points for an $80 deposit through the remainder of the calendar year.

The Pundit’s Mantra

So why is this a big deal for me? In my case, I frequently convert my points into cash. Moreover, I also transfer points to airlines and hotels when Amex runs transfer bonuses.

I have a pretty substantial chunk of Amex Membership rewards points. Every now and then, in order to de-risk against a possible shutdown or a clawback, I transfer points out or convert to cash. This year, I’ve already liquidated close to 500,000 points and will now need to be cognizant about closing in on that 1 million mark going forward.

Nevertheless, I plan to keep the card for a year, since I don’t have to worry about its renewal until 2025.

As a Charles Schwab Platinum cardholder, how does this change affect you? With any change, there are winners and losers. If you’re someone who frequently liquidates points and converts to cash, then this change is definitely a net negative. If you have a smaller points balance and you don’t transfer points out often to Charles Schwab, then it’s less likely to be that big an issue.

___________________________________________________________________________________________________________________

Earn 5 free hotel nights from a single credit card welcome bonus.

Click here to know more…

___________________________________________________________________________________________________________________

Never miss out on the deals, news and travel industry trends. Like us on Facebook, follow us on Instagram and Twitter to keep getting the latest content!

Why would anyone convert Amex points to cash even at 1.25 cent a point? If you are that hard up for money you shouldn’t have a Platinum card. I transfer mine to Emirates and book business class seats where I usually get 5-8 cent a point in value versus paying cash. Even converting to Delta you can get better than 1.25 cent if you go with their flash sales.

Never understood people that convert points to cash. Very suboptimal

I’ve got 1.5M points and will likely convert them to cash since I intended to

use them for fine hotels & resorts. It turns out that’s a much better deal.

I get 5x points for booking and paying cash, and $16,500 into Schwab account.

So net 82,5000 points and addition $1500 vs direct booking w points.

Unfortunately, I used amex points for FHR booking 2 yrs ago. Won’t make that

mistake again.

That’s great. Every now and then, I convert points to cash at 1.1 if the cpp I’m getting on a hotel or airline booking is lower. That’s another option on the table.