Credit card issuers place a myriad of restrictions on who can get a particular card product or a welcome bonus. In certain cases, an issuer may give you the card but not the welcome bonus. In other cases, an issuer may deny you a card outright. Moreover, certain issuers also place restrictions on how many cards you can get. For many miles and points enthusiasts, American Express is one of the favorite card issuers due to their strong portfolio of travel card products. However, American Express, unlike other issuers has Charge cards and Credit cards, which makes this recent report an interesting update for some. Also, American Express is known to crack down pretty hard on any behavior that it deems as suspicious.

Amex Green Card – Charge card or Credit card?

As per this post by Doctor of Credit, many Reddit users are pointing out that Amex is now counting the Green card as a credit card instead of a charge card. Previously, there was some confusion about this as certain readers pointed out that Amex was doing this for account where the ‘pay over time’ option was enabled.

However, if these recent developments signal a trend, then it could well mean that the Green card would count towards your maximum card limit with American Express in the form of a credit card.

Why does this matter?

Last year, many readers reported that American Express had made a change to their five card limit. Instead, they’d reduced it to a four card limit per customer. Why does this matter though? Many frequent travelers have more than two or three American Express cards. Previously, one assumed that charge cards never counted towards this limit. If the Green card indeed now counts as a credit card, then it would impact certain Amex customers negatively.

Firstly, if you currently have the Green card and are near the limit, it may restrict you from getting another card. Secondly, if you already have four credit cards and apply for the Green card, then Amex may reject your application citing that the Green card would be your fifth credit card.

The Pundit’s Mantra

If you’re close to Amex’s maximum limit, this recent update may affect your card application strategy going forward. As of now, I have a combination of 2 charge cards and 3 credit cards with Amex, but I haven’t tried pushing the four card limit by applying for another one.

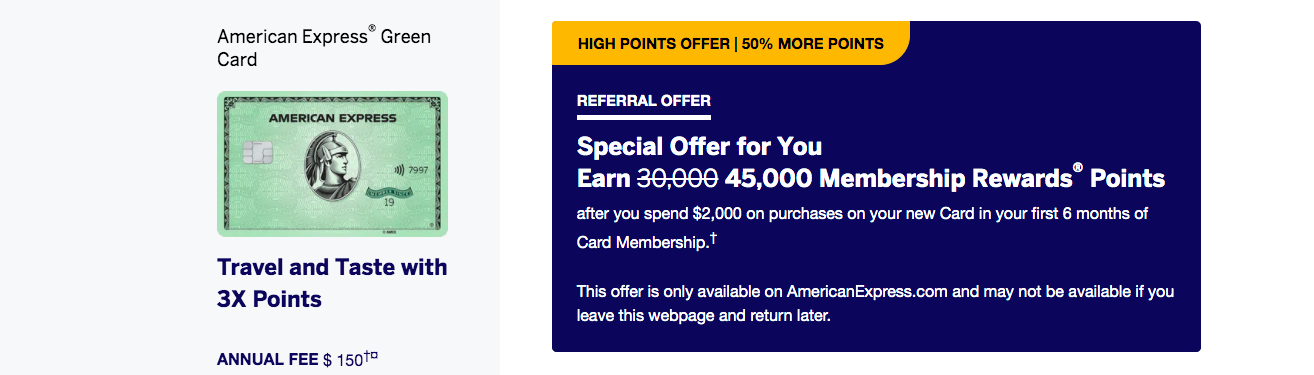

If you’re eligible, then the Amex Green card is currently offering a welcome bonus of 45,000 Membership Rewards points. You’ll earn a welcome bonus of 45,000 points after you spend $2,000 in the first 6 months.

Have you run into issues with Amex’s new four credit card limit? If yes, have you had particular issues with how they classify the Amex Green Card? Tell us in the comments section.

Hat Tip to Doctor of Credit

___________________________________________________________________________________________________________________

The Chase Sapphire Preferred is currently offering a limited time welcome bonus of 60,000 Ultimate Rewards points and a $50 statement credit on grocery purchases. You’ll earn a welcome bonus of 60,000 Ultimate Rewards points after you spend $4,000 in the first 3 months. You’ll also earn 2x points all on all travel and dining spend and 5x points on Lyft rides.

(Chase’s 5/24 rule may apply to this card. Moreover, Chase may deny you a bonus for this card in you’re received a welcome bonus on any of the Chase Sapphire cards in the last 48 months.)

APPLY NOW

___________________________________________________________________________________________________________________

Never miss out on the deals, news and travel industry trends. Like us on Facebook, follow us on Instagram and Twitter to keep getting the latest content!

___________________________________________________________________________________________________________________

Disclosure: The Points Pundit receives NO compensation from credit card affiliate partnerships. However, you can support the blog by applying for a card through my personal referral links. This article is meant for information purposes only and doesn’t constitute personal finance, health or investment advice. Therefore, please consult a licensed professional for advice pertaining to your situation.