Over the last year or so, we’ve seen the world of travel change drastically. On one hand, international travel has come to a standstill. On the other hand, domestic travel is picking up, albeit in pockets. However, we’ve seen card issuers compete and offer credits to entice customers to keep renewing their premium credit cards that charge a hefty annual fee. Many customers have opted to switch from premium credit cards to cash back cards, which offer a better return on everyday spend, for a lower annual fee. Last week, I wrote about the 30,000 points welcome bonus that the Amex Everyday Preferred card is currently offering. Similarly, you can earn a welcome bonus of up to $350 with the Amex Blue Cash Everyday card, which unlike the Everyday Preferred, earns cash back instead of Membership Rewards points.

Amex Blue Cash Everyday Credit Card

Welcome Bonus

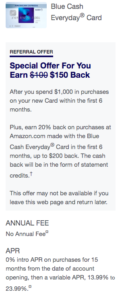

You’ll earn a welcome bonus of $350 in total. After you spend $1,000 in the first six months, you’ll earn an initial bonus of $150. Moreover, you’ll earn 20% back on Amazon.com purchases, up to a total of $200 in cash back. Also, you’ll get a limited time intro APR of 0% for the first 15 months.

Cash Back

You’ll earn cash back in the following categories. The cash back will show up as Reward Dollars.

-

- 3% cash back at U.S Supermarkets (up to $6,000 per year, then 1%)

- 2% cash back at U.S Gas Stations and at select U.S department stores

- 1% cash back on all other eligible purchases

As per the terms and conditions, here’s how you can use the Reward Dollars.

You will earn cash back only on eligible purchases and in the form of Blue Cash Reward Dollars (reward dollars). You can redeem reward dollars for statement credits whenever your available reward dollars balance is 25 or more. You cannot use cash back to pay your Minimum Due. The number of reward dollars you earn is based on a percentage of the dollar amount of your eligible purchases during each billing period. From time to time we may at our option offer you other ways to redeem reward dollars, such as for gift cards or merchandise.

Apply Now for the $350 Bonus

(If the $150 + $200 offer doesn’t show up right away, you can try opening the link in incognito/private browsing mode or try different browsers after clearing your browsing history and cookies)

___________________________________________________________________________________________________________________

The American Express Gold Card is currently offering a welcome bonus of 60,000 Membership Rewards points. You’ll earn a welcome bonus of 60,000 Membership Rewards points after you spend $4,000 in the first 6 months after you’re approved for the card.

Moreover, the card offers lucrative bonus earning categories, benefits and credits.

- 4x points on dining (including takeout and delivery) and grocery spend

- 3x points on flights

- $120 dining credit annually

- $120 Uber Eats/Uber credit annually

- $100 airline credit (ends on December 31, 2021)

- No foreign transaction fees

Apply Now

Please note that American Express may not approve you for the welcome bonus on this card if you currently have the card or have had the card in the past and received a welcome bonus for the same. This may also include any upgrade or downgrade offers that you may have signed up for.

___________________________________________________________________________________________________________________

Never miss out on the deals, analysis, news and travel industry trends. Like us on Facebook, follow us on Instagram and Twitter and get the latest content!

___________________________________________________________________________________________________________________

Disclosure: The Points Pundit receives NO compensation from credit card affiliate partnerships. Support the blog by applying for a card through my personal referral links. This article is meant for information purposes only and doesn’t constitute personal finance, health or investment advice. Please consult a licensed professional for advice pertaining to your situation.