Editorial Note: I receive NO compensation from affiliate partnerships. Support the blog by applying for a card through my personal referral links.

If you have a lot of Amex points or a lot of American express cards, there’s been a lot happening off late. Amex has been in the news over the last few weeks. A few of the reasons have been good, a few bad and a few ugly. In case you missed, here are some of the key stories that are vital in order to see what American Express is up to here.

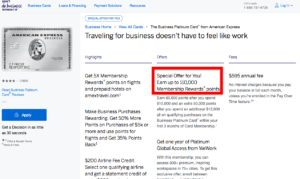

Elevated Membership Rewards Sign-up Bonuses

If you’re looking to rack up some valuable Membership Rewards points, then there’s a 110,000 points bonus out there. After you’re approved for the Amex Business Platinum Card, you’ll earn a total of 110,000 membership rewards points once you meet the minimum spend.

If you apply through the incognito mode on your browser, you can currently apply for the 110,000 Membership Rewards points offer. You’ll earn 60,000 Membership Rewards points after you spend $10,000 in the first 3 months. After you spend an additional $15,000 in the same period, you’ll earn another 50,000 Membership Rewards points. In essence, you’ll have at least a total of 135,000 bonus Membership Rewards points after getting the sign-up bonus and meeting the minimum spend.

Similarly, there’s also an elevated offer on the Business Gold Card. If you apply via referral, you’ll get a total of 75,000 Membership Rewards points. You’ll earn 50,000 points after you spend $5,000 and then an additional 25,000 points when you spend an additional $5,000 in the first 3 months.

Referral Clawbacks

American Express has been pretty severe in enforcing clawbacks and in some cases shutting down customer accounts for referral fraud abuse. It’s vital to note that you must not self refer or you will attract Amex’s attention. This post I wrote earlier during the week lays down the terms and conditions with the fine print about how Amex may enforce a potential points claw back or a complete shutdown.

Amex Shutdowns

In this post, I covered some data points from Reddit about customer shutdowns. These are good data points and provide an insight into what’s happening. While these shutdowns are surely happening in waves, I think that there’s not much to be concerned about if you’re simply playing by the rules and putting a lot of organic spend on Amex cards. Also, I think that it’s vital that one looks at the data and numbers before jumping to conclusions.

The Pundit’s Mantra

It seems like American Express is taking a two pronged approach. One one hand, they’re weeding out or putting barriers for customers they deem unprofitable. On the other hand, they’re offering generous bonuses to customers on some of their credit cards.

The elevated sign-up bonuses on the business credit cards are exciting. I find Membership Rewards points to be extremely valuable. However, in light of all the shutdowns and the referral clawbacks, do you still plan on hitting up some of these lucrative sign-up bonuses? Let us know in the comments section.

Never miss out on the best miles/points deals. Like us on Facebook, follow us on Instagram and Twitter to keep getting the latest content!