Yesterday, the blogosphere lit up as Amex launched a couple of really tempting welcome offers on their Amex Platinum Card. For many, the 100,000 points Amex Platinum offer is a dream offer for racking up Membership Rewards points. Doctor of Credit reported that Amex could well be targeting certain customers for a possible 125,000 Amex Platinum Card offer.

Amex Platinum Card: Up 125,000 points up for grabs

Post Covid-19, Amex made a slew of changes and added a bunch of useful credits and bonus categories to many of their cards. Till the end of this year, you can still use many of the credits. However, these newer offers take it a notch higher. Firstly, let’s have a look at the two offers that many readers are currently seeing.

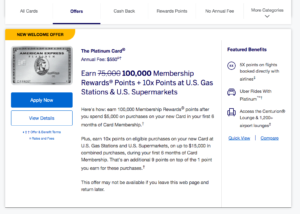

100k Offer

At the moment, it seems to be a lot easier to see the 100k offer. You can click on this link to view the offer. I was able to see it on the third attempt after switching browsers and clearing my history and cache.

What’s so great about this offer? Well, it’s probably the best offer I’ve seen on the card in terms of earning points well beyond the welcome bonus. I’ll not delve into all the features of the card but instead focus on the unique features of the offer:

- Earn a welcome bonus of 100,000 Membership Rewards points after you spend $5,000 in the first 6 months

- Earn 10x points at US Gas Stations and Supermarkets, up to $15,000 in combined purchases in the first 6 months

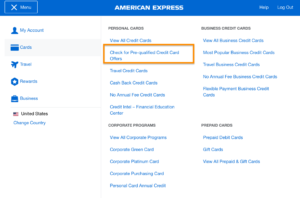

125k Offer

This offer is a lot more targeted. Readers are reporting that they see the offer when they check for pre-qualified offers on the Amex website. As per Doctor of Credit, many people are seeing a similar offer by using a pre-qualified offer link on the Amex website. This offer is better than the previous one.

- Earn a welcome bonus of 125,000 Membership Rewards points after you spend $5,000 in the first 6 months

- Earn 10x points at US Gas Stations and Supermarkets, up to $15,000 in combined purchases in the first 6 months

Eligibility

Here’s where the rubber hits the road.

Once in a lifetime rule

As per Amex’s own restrictions, Amex will not give you a welcome bonus once again for the same card. However, as per many data points, that ‘lifetime’ can often be a gap of 6-7 years between welcome bonus in order to become eligible again.

Pop-up Jail

Back in 2018, Amex started alerting cardmembers in advance about their eligibility for welcome bonuses.

After you enter all the details and hit ‘apply now’, you’ll see the popup if you’re not eligible. Amex displays two versions of this popup. Firstly, you’ll be deemed ineligible because you’ve received the bonus before. Secondly, Amex may also deny you based on what they describe your ‘history’ with Amex. This could entail a few factors like number of cards, amount of spend, history of returning items, canceling cards and so on.

Amex’s Secret Sauce

This really is more of an exception rather than the rule. Every now and then, you’ll see data points where certain readers have gotten offers for the same card twice because Amex targeted them. Others have simply been lucky by applying for the same bonus, escaping the dreaded Amex popup and getting the points. However, this is a highly YMMV situation and totally depends on how Amex’s algorithm determines your eligibility for a particular offer.

Other Amex Rules & Restrictions

In addition to the factors above, many of Amex’s generic card application rules also apply.

- American Express may limit you to four credit cards (doesn’t include charge cards)

- American Express may not approve you for more than three cards in a 90 day period

- Unlike other issuers, you may lose out on the opportunity to get the bonus on the card if you’ve done a product change in the past. For example, if you had the Gold card and upgraded to Platinum, then Amex may deny you a welcome bonus for a new Platinum card

The Pundit’s Mantra

If you’re able to see the offers by simply logging in or by using the pre-qualify tool on the Amex website, then you should be good to go. If not, I’d advise that you tread carefully. Amex can be pretty forceful about clawing back points or shutting down accounts if you apply for offers that weren’t meant for you. By all means, publicly available offers shouldn’t be an issue at all.

These offers upwards of a 100,000 Membership Rewards points are extremely tempting. I hope this post was able to shed some light on Amex’s approval requirements and your eligibility for one of these offers.

Which offer are you seeing for the Amex Platinum card? Tell us in the comments section.

___________________________________________________________________________________________________________________

Never miss out on the deals, analysis, news and travel industry trends. Like us on Facebook, follow us on Instagram and Twitter and get the latest content!

___________________________________________________________________________________________________________________

Disclosure: The Points Pundit receives NO compensation from credit card affiliate partnerships. Support the blog by applying for a card through my personal referral links. This article is meant for information purposes only and doesn’t constitute personal finance, health or investment advice. Please consult a licensed professional for advice pertaining to your situation.