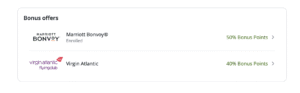

Frequent readers of the blog may have noticed that I’m a strong advocate of accumulating transferable points currencies. One of the favorite features that we all love about flexible points currencies is that every now and then, issuers offer transfer bonuses. In some cases, these bonuses are as low as 10% or as high as 70%. Over the weekend, we saw that Chase is out with a brand new points transfer bonus. You can earn a bonus of 40% when you convert your Chase Ultimate Rewards points into Virgin Atlantic’s frequent flyer program. In addition, Chase is already offering a 50% points transfer bonus to Marriott Bonvoy as well. Both these transfer bonuses are slated to end on February 28, 2026 at 11:59 ET.

So, to address the elephant in the room, should you preemptively transfer points over during these bonuses?

Yes, you should transfer points

- Securing Award Space Quickly: This only makes sense if it takes a while to transfer points over to an airline. If your points transfer over instantly, then you don’t need to transfer points in advance. However, let’s say I’m planning to fly to SE Asia in Spring 2026. It only makes sense to transfer points right now during a bonus if there’s going to be significant time taken once award space opens up. Else, it’s just better to sit on points and transfer over when the deals pop up. For example, I love Singapore Airlines’ spontaneous escape deals. Each month, you get 30% off on premium cabin award tickets on select routes. However, I can transfer points from Amex to Singapore Airlines and they transfer over almost instantly. Therefore, I don’t need to transfer in advance and wait for a deal. However, for other airlines that take longer to transfer, it may make sense.

- Massive points balance: It may make sense to transfer a few points over speculatively if you have a fat balance already (I’m talking 7 figures or more). That way, you will still have a lot of points left after you transfer over and also get to make good use of the transfer bonuses. For example, I have 6 figure balances with both Chase and Amex. At the start of last year, Amex was offering a targeted 40% bonus while transferring Amex points to Hilton. I converted 179,000 Amex points into 500,000 Hilton Honors points. Last year, Chase was offering a 70% bonus while transferring to Marriott. I converted 100,000 Chase points into 170,000 Marriott Bonvoy points and booked this amazing trip.

- Hedging and diversification: If you transfer to airlines and hotels during transfer bonuses, you can protect yourself against a potential devaluation of the bank’s points currency. Some in our hobby do this if they’re worried about Amex shutting down their account for violation of terms and conditions.

No, you shouldn’t

- Hedging against loyalty program devaluation: Airline and hotel loyalty programs devalue all the time. We’ve seen hotel award charts disappear, we’ve seen the same happen to major airline programs like United and Delta. If you transfer your points into one bucket and that program devalues, then you’re suddenly left with the same amount of miles or points, but they’re now worth a lot less than they were before. Therefore, if you’re not sure about an upcoming trip, then it’s just best to wait around and transfer until something comes up.

- Miles & points expiration: For most transferable points currencies, it’s pretty easy to keep your points active as long as your credit card is active. What’s worse than a devaluation though? Losing all your points altogether! Imagine being a situation where you transferred your points to a hotel chain and your points expired after one year. If that’s what you fear, then it’s best to simply keep your points as they are and not transfer them in advance.

- Irrational Choices: Transfer bonuses can often trigger irrational choices. Just because an airline bonus is on, should I fly that airline? Does the schedule suit me? What type of aircraft is it? Am I getting good value for the miles I’m using? For example, if Amex is currently offering a 15% points transfer bonus to Avianca LifeMiles, I would still be holding back and not transferring. Why? Because I don’t have any trips planned on their Star Alliance partners yet. Also, I’ve found it a bit tough dealing with their customer service if there’s an issue. So, I’m just holding back and waiting, instead of making an irrational choice, just because there’s a ‘deal’ on the market.

The Pundit’s Mantra

I love my transferable points currencies. I love the flexibility offer but take a very cautious approach when it comes to transferring points over during transfer bonuses.

What’s the strategy that you follow when it comes to points transfer bonuses? Tell us in the comments section.

___________________________________________________________________________________________________________________

Subscribe to my channel for the latest in miles, points & travel..

___________________________________________________________________________________________________________________

Credit Card Offers

American Express Business Credit Cards

- Earn 200,000 Membership Rewards points with the Business Platinum Card

- Earn 100,000 Membership Rewards points with the Business Gold Card by American Express

Chase Sapphire Cards

- 75,000 Chase Ultimate Rewards points up for grabs with the Chase Sapphire Preferred Card!

- Earn 125,000 bonus points with the Chase Sapphire Reserve Card

- Earn 155,000 bonus points with the Chase Sapphire Reserve Card for Business Card

- Chase Ink Business Preferred Card offering a limited time welcome bonus of 100,000 points

Marriott Bonvoy