Last week, I’d written about that fact that multiple Amex welcome bonuses were ending on both personal and business versions of their Delta credit cards. With those offers, one could earn up to 110,000 Delta SkyMiles. While the business credit card offers have now gone away, I’m still seeing elevated offers on the personal co-branded Delta credit cards. I was able to see these offers in incognito/private browsing mode on Amex’s website and also via referral links.

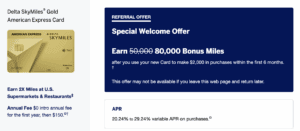

Delta SkyMiles Gold American Express Card

With this offer on the Delta SkyMiles Gold American Express Card, you’ll earn a welcome bonus of 80,000 miles. You’ll earn the bonus once you spend $2,000 in the first 6 moths of card membership. Moreover, you’ll pay no annual fee for the first year. The annual fee from the second year onwards will be $150.

Apply Now for the 80,000 Miles Offer

Delta SkyMiles Platinum American Express Card

With this offer on the Delta SkyMiles Platinum American Express Card, you’ll earn a welcome bonus of 90,000 miles. You’ll earn the bonus once you spend $3,000 in the first 6 months of card membership. This should be pretty easy for most people to attain as you only need to spend $500 in each month for 6 months. This card carries an annual fee of $350, but you can earn up to $400 in credits each year, in addition to a companion certificate and the opportunity to earn elite status.

Apply Now for the 90,000 Miles Offer

Delta SkyMiles Reserve American Express Card

With this offer on the Delta SkyMiles Reserve American Express Card, you’ll earn a welcome bonus of 100,000 miles. You’ll earn the welcome bonus once you spend $5,000 in the first 6 months of card membership. While the card carries an annual fee of $650, this is a great card if you value elite status, visit airports with Delta lounges and also value the companion certificate that comes with the card, in addition to the multiple statement credits on offer.

Apply Now for the 100,000 Miles Offer

The Pundit’s Mantra

Overall, these offers are fantastic if you were looking to apply for co-branded consumer Delta credit card but missed out during the last few weeks. If you’re simply looking to test the waters, then then Gold card would be a great option, since you don’t pay anything in annual fees in the first year.

However, if you’re looking to ramp up your travel with Delta, then the Platinum card is a better option. If you’re a frequent traveler with Delta and live at or travel to a Delta hub frequently, then the Reserve card is a very useful card to carry.

Which is your favorite co-branded Delta Skymiles credit card? Tell us in the comments section.

___________________________________________________________________________________________________________________

Have an interesting travel story? Subscribe to my podcast and join the conversation

___________________________________________________________________________________________________________________

New Credit Card Offers

American Express Business Credit Cards

- Earn 200,000 Membership Rewards points with the Business Platinum Card

- Earn 150,000 Membership Rewards and enjoy a 0% intro APR on the Business Gold Card

Chase Sapphire Cards

- Earn 100,000 bonus points and a $500 statement credit with the Chase Sapphire Reserve Card

- Earn 200,000 bonus points with the Chase Sapphire Reserve Card for Business

Co Branded Hilton Honors Cards

- Earn 100,000 bonus points and a $100 statement credit with the Hilton Honors American Express card

- No fee for the first year, earn 130,000 bonus points with the Hilton Honors American Express Surpass card

- Earn 175,000 bonus points with the Hilton Aspire card, in addition to 1 free night certificate each year

- Earn 175,000 bonus points with the Hilton Business Card

___________________________________________________________________________________________________________________

Never miss out on the deals, news and travel industry trends. Like us on Facebook, follow us on Instagram and Twitter to keep getting the latest content!