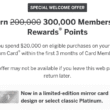

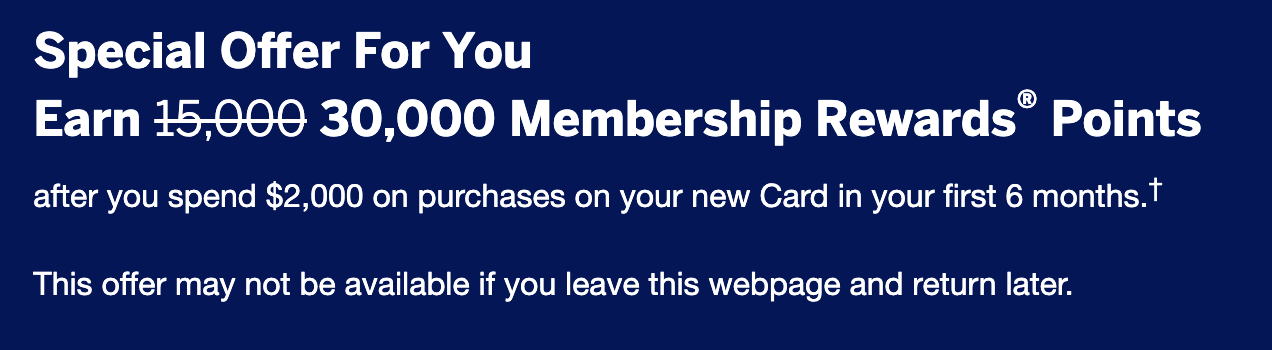

The Amex Everyday preferred card is a great option to kickstart building a good chunk of Membership Rewards points on everyday purchases like groceries and gas stations. Currently, American Express is offering a welcome bonus of 30,000 points in addition to a temporary APR of 0% on purchases.

AMEX EVERYDAY PREFERRED CARD

With this welcome bonus, you’ll earn 30,000 bonus Membership Rewards points after you spend $2,000 in the first 6 months. This is double the standard welcome bonus of 15,000 points.

Also, if you’re looking to finance some purchases, then this card is offering a 0% intro APR. The 0% intro APR will be valid for the first 12 months. The annual fee for this card is $95.

CLICK HERE FOR THE 30,000 POINTS + 0% APR OFFER

(Tip: If the 30,000 points offer doesn’t show up right away, you can clear your cookies/browsing history and/or use private/incognito browsing mode)

BONUS SPEND CATEGORIES

This card offers great return on everyday spend. Following are the bonus categories on this card:

- 3x Membership Rewards points per dollar spent on groceries (supermarkets)

- 2x Membership Rewards points per dollar spent at gas stations

- 2x Membership Rewards points per dollar spent at AmexTravel.com

- 1x Membership Rewards points per dollar spent on all other purchases

If you make 30 purchases in a month, you’ll earn 50% extra points. In effect, the 3-2-1 spending categories will become 4.5-3-1.5 bonus Membership Rewards points categories per dollar spent. However, Amex caps your bonus points earning in the supermarkets category at $6,000 spent per year.

AMEX EVERYDAY PREFERRED CARD EARNS TRANSFERRABLE POINTS

If you have this card, you can transfer points to Amex’s airline and hotel partners. If you use this as your go-to card for everyday purchases and make 30 transactions each month, then the points could add up pretty quickly. Moreover, if you max out the Supermarkets category, you’ll end up with an additional 27,000 points in a single year. If you add the sign up bonus, then you’d have earned a minimum of 57,000 points after the very first year. That’s amazing return on spend for a card charges an annual fee of $95.

OTHER BENEFITS

In addition, Amex offers many other standard benefits that are similar across many of their cards.

- Car rental loss and damage insurance

- Dispute resolution

- Fraud Protection

- Pay It/Plan It

- Return Protection

THE PUNDIT’S MANTRA

Overall, this card is a great option as it gives you the ability to earn transferrable points without paying a hefty annual fee. Moreover, you also have the option to downgrade to the no annual fee Amex Everyday card after the year if you think that this card isn’t the best for your spending habits.

Which is your go to card for everyday spend? Tell us in the comments section.

APPLY NOW FOR THE 30,000 POINTS + 0% APR OFFER

___________________________________________________________________________________________________________________

Never miss out on the deals, analysis, news and travel industry trends. Like us on Facebook, follow us on Instagram and Twitter and get the latest content!