Disclosure: I receive NO compensation from credit card affiliate partnerships. Support the blog by applying for a card through my personal referral links.

We often write about some of the best credit cards that can help you attain your travel goals. While the welcome bonus may be attractive, I always advocate that a long term strategy is the best way to proceed. Last week, I wrote about how you can ask politely for a retention offer before you cancel your card. In the past, I’ve canceled cards when I’ve not seen much long term value. However, what happens when you change your mind after you cancel?

Why should you reopen a credit card?

In which circumstances would you want to reopen a credit card that you’ve already closed?

New Benefits

Card issuers are constantly in the process of reevaluating and making changes to their products. In certain cases, they make changes based on market research that they conduct in order to study consumer preferences. In other cases, they respond to a move made by the competition. For example, Chase recently made changes to their Sapphire Reserve card. If you’re interested in a deep dive into the market forces that influenced this decision, read this post where I crunch the data that was the backbone of Chase’s new product partnerships.

Elite Status

Many credit cards offer automatic elite status. Since I primarily stay with Hilton, I carry the Hilton Aspire Card as it gives me automatic top-tier Diamond status. If you had a card that you canceled but miss the elite status on your next stay, you may want to reopen that credit card.

Change in Travel Patterns

Let’s say that you were based out of San Francisco. You changed your job and now you’ve moved to Atlanta. All of a sudden, you find that flying Delta is the best option from your home airport. In such a case, you’d find a co-branded Delta American Express really handy. You’d get free checked bags, priority boarding and a pathway towards earning elite status. In such a case, how do you go about reinstating a card that you’ve closed?

Business Platinum Card

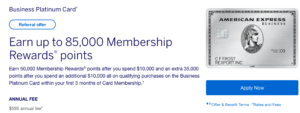

I carried the Business Platinum Card for a couple of years. When I signed up, I got a 75,000 Membership Rewards points welcome bonus after spending $5,000 in the first three months. Currently, you can earn a welcome bonus of up to 85,000 Membership Rewards points via Amex’s referral links.

Apply Now for the 85,000 Membership Rewards points Welcome Bonus

Closing the Card

Last year, Amex increased the annual fee on the card to $595. While they added new benefits like the Dell credit, I wasn’t quite sure if it was really valuable for me since I primarily use Apple products. Also, late last year, we heard the news that Amex wasn’t going to renew their partnership with WeWork. Given WeWork’s own financial woes and the end of the partnership, I decided to cancel my card. I even wrote about how bizarre my retention offer call for this card was.

Reopening the Card

Only a couple of weeks after I closed the card, I read a post about Amex extending the benefit till the end of 2020. I received the final conformation when I got an email from WeWork about the same. I used the WeWork benefit extensively when I had the Business Platinum Card. At this point, I decided to call Amex about possibly reopening the card.

Amex Customer Service

I called Amex’s customer service in order to check what their policy was. I spoke to a rep who transferred me to their ‘reinstation’ department. The rep told me that it had been more than 30 days since I canceled the card. Therefore, if I were to reopen the card, Amex would treat it as a new card and my card number would change. Also, I’d not be eligible to receive the welcome bonus again as per Amex’s once per lifetime rule.

Before initiating the process, the rep asked me the reason for reopening the card. I mentioned that WeWork was clearly a benefit that I use and value. The rep then asked me to confirm basic details like name, address, phone number and the last four digits of my social security number. After a couple of minutes, the rep informed me that my request to reopen the Business Platinum Card was approved!

The Pundit’s Mantra

The credit card landscape is constantly changing. Banks are constantly making updates and changes to their products. With American Express, the process to reopen a closed credit was pretty quick and simple. If you’re looking to reopen a closed credit card, then Doctor of Credit has a pretty handy list of the policies for each card issuer.

Have you canceled a card and then reopened it? Which other issuer has let you reopen a closed credit card? Let us know in the comments section.

___________________________________________________________________________________________________________________

Are you looking to earn a great deal of Ultimate Rewards points? Then you can apply for the Chase Ink Business Preferred Card. You’ll get a welcome bonus of 80,000 Ultimate Rewards points! (Chase’s 5/24 rule applies to this card)

Never miss out on the best miles/points deals. Like us on Facebook, follow us on Instagram and Twitter to keep getting the latest content!