Last week, I wrote about how one can attempt to get a retention bonus offer from a card issuer once the annual fee hits and you’re unsure about renewing the card. I shared some tips and tricks about how to go about it. You read that post here.

Retention Bonus Attempt

I’ve carried the Charles Schwab American Express Platinum card in my wallet for a few years. Since I have a brokerage account with Schwab, it gives me the ability to convert my American Express Membership points into cash. With the card, I can convert my points into cash at a rate of 1.1 cent per point. If I convert 100,000 Membership Rewards points, $1,100 is deposited into my Schwab Brokerage account.

Retention Offer via Chat

Unlike other card issuers, Amex makes it really easy these days to get in touch with a ‘retention specialist’. Instead of calling, you can initiate a chat after you log into your Amex account. Once you mention that you’re looking to cancel a card, the chat rep will automatically connect you to a retention specialist.

When the rep asked me the reason for cancellation, I said that I really loved the Audible benefit and don’t find the other credit very useful now that Audible has been done away with. As expected, the rep touted all the other benefits and asked if I found them valuable.

At the end of the chat, I said that I would still like to go ahead and cancel the card. This is when the rep said that he could offer me an incentive as a valued customer if I can keep the card open for another year. The agent outlined a couple of different options:

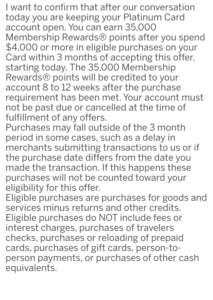

- 35,000 Membership Rewards points after I spend $4,000 in 3 months

- A one-time statement credit of $350 after I spend $4,000 in 3 months

The Pundit’s Mantra

I decided to go for the points offer instead of the statement credit. Even if I decide to liquidate 35,000 points into my Schwab account, I’ll end up with $385, which is more than the $350 that Amex offered me.

While I’m not a great fan of the ‘new’ Amex Platinum card, given its web of confusing credits split up into different time frames, it’s always great to get a retention bonus offer to keep the card for another year. Also, since it’s a Schwab Platinum card, I like the option of being able to cash out my points whenever needed.

How did your recent attempt at getting a retention bonus offer pan out? Tell us in the comments section.

___________________________________________________________________________________________________________________

Never miss out on the deals, news and travel industry trends. Like us on Facebook, follow us on Instagram and Twitter to keep getting the latest content!

I have the Morgan Stanley Platinum, and over the past few weeks have only been offered 15k or 150 for 3k spend. Not worth it. Will try one more time today, but I have to cancel by today if I’m not keeping it. Hoping/figure I can always apply later for a regular old Platinum? Would I be able to get a sub after having the Morgan Stanley? Thanks

Amex recently made changes to the rules that apply to getting welcome bonuses on different types of Platinum cards. So you may not qualify, unless you are targeted with an offer. https://frequentmiler.com/amex-family-language-is-it-time-to-grab-cards-while-you-still-can/

I tried the same yesterday for my P2’s Amex vanilla Platinum. Eventually they offered 25k in MR points for 3k in spend over 90 days. I declined saying I want to think about it. I will try again in a couple of weeks.

25k is not bad if you intend to renew the card!

I tried the same through chat a couple of days ago after my nearly $1100 annual fee posted for my personal AMEX Platinum (+2 authorized users). After much back and forth, I was offered 30K MR’s for $4k in spend, which amounted to $300 in my opinion. In the end I did cancel the card. Increasing their fees as well as taking away guest lounge access for the primary and no lounge access for AU’s really did me in on this card. We don’t use UBER, so those credits were out and I’ve been unable to use the airline credits for the past two years as I have top tier status with two top airlines where I’m essentially hub locked. IMO they just got too greedy while trying to reduce lounge crowding, but as often as we travel as a family of 3, I’ll just use my Citi AA Exec card so we can all enjoy the lounge together at no additional charge.

I’m in the same boat, don’t use Uber or the entertainment credit, but still find the FHR credit and airline credit useful. Centurion lounge access is something that I use frequently as a solo business traveler without guests.