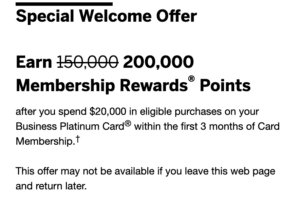

The Business Platinum Card is currently offering an amazing welcome bonus of 200,000 Membership Rewards points. American Express offers some of the best welcome bonuses on the market. While they charge high annual fees on many of their premium card products, their products can be a fantastic value proposition for the first year in case you’re simply looking to try and then reconsider, thanks to some really high welcome bonuses on offer.

BUSINESS PLATINUM CARD WELCOME BONUS

You will earn a welcome bonus of 200,000 Membership Rewards points on the Business Platinum Card after you spend $20,000 in the first 3 months of card membership. The annual fee for this card is $695.

Apply Now for the 200,000 points offer

If you’re not able to see the offer immediately, then you can try the following options:

- Copy and paste the link in a fresh browser

- Open the link in incognito/private browsing mode

- Clear your browser history/cookies and try again

- Use a VPN

Business Platinum Card: Benefits and Bonus Spend

If you have legitimate business spend coming up, then this is a fantastic offer.

In addition to the welcome bonus, you’ll also get many of the awesome benefits that the card offers already:

- $200 Airline Fee Credit (per calendar year): You can get the airline fee credit worth $200 right away after you’re approved. Then get another $200 once 2026 begins. That’s already $400 in value for a card that charges a $695 annual fee. This post details how I’ve used my airline fee credit benefit for 2025.

- $200 Dell credit ($100 credit each between Jan-June and July-Dec each year): Amex splits the Dell.com credit mid way through the year. So you can get a $200 credit now and then get another $200 between July and December of 2025. Even if you decide to cancel the card, you can still get another $200 in January 2026 even if you decide not to renew the card. That’s a total value worth $600 in Dell.com purchases.

- $360 Indeed Credit: The Business Platinum Card offers an Indeed.com credit that’s split quarterly with a credit of $90 per quarter. Between now and March 2026, you can use this $90 credit five times, adding up to $450 in value.

- $120 TSA Pre-check/Global Entry Credit

- $120 Telephone Bill credit: With the Business Platinum Card, you’ll get a $10 statement credit when you charge your wireless telephone bill from a qualifying carrier each month. If you charge your bill each month, you can get up to $120 in credits. Moreover, you’ll get cell phone protection insurance when you simply use your card to pay your phone bill.

- $199 Clear Plus Credit

- $200 Hilton Credit: This is the newest benefit that Amex has added to the card. Here’s a guide that I recently published on how you can maximize this new benefit and earn $200 in credit annually.

Bonus Points

With the Business Platinum card, one of my favorite benefits still is the 35% points rebate. You can earn the points rebate when you book any flight with the airline of your choice (the same US based airline which you selected for the airline fee credit benefit) or for any qualifying business or first class ticket when you use the Pay with Points feature on Amextravel.com.

- 35% Bonus on Pay with Points with your airline of choice

- 5x points on flights and prepaid hotels hotels booked via Amextravel.com

- 1.5x points per dollar spent on purchases above $5,000

Benefits and Perks

In addition to credits and benefits, you’ll enjoy lounge access and complimentary elite status with Marriott and Hilton.

- Centurion Lounge Access, Priority Pass Select Membership and access to Delta SkyClubs

- Fine Hotels and Resorts Program

- Complimentary Hilton Honors Gold Elite Status

- Complimentary Marriott Bonvoy Gold Elite Status

- Deals and discounts via the International Airline Program

- Car Rental elite status and discounts with Avis, National, Hertz

Insurance and Protections

- Return Protection

- Trip Cancellation & Interruption Insurance

- Trip Delay Insurance

- Baggage Insurance Plan

- Car Rental Loss & Damage Insurance

- Extended Warranty

- Purchase Protection

The Pundit’s Mantra

Even though the card charges an annual fee of $695, the welcome bonus and added benefits can help you recoup a lot of the money spent on the annual fee, simply by maximizing the $200 airline fee credit and $200 Dell credit each year. While the annual fee isn’t cheap by any means, you can always keep the card for the first year, earn the welcome bonus, maximize the credits and then take a call about whether you’d like to renew for a second year. Overall, the 200,000 Membership Rewards points bonus definitely makes this a card worthwhile during your very first year of card membership.

APPLY NOW FOR THE 200,000 POINTS OFFER

___________________________________________________________________________________________________________________

Never miss out on the deals, analysis, news and travel industry trends. Like us on Facebook, follow us on Instagram and Twitter and get the latest content!