Amex recently increased the annual fee on the Business Platinum card to $695. That increased annual fee goes into effect on January 13, 2022. However, if you sign up now, you can get a massive 150,000 Membership Rewards points as a welcome bonus. Moreover, you’ll pay the $595 annual fee instead of $695 if you get this card before the 13th of January.

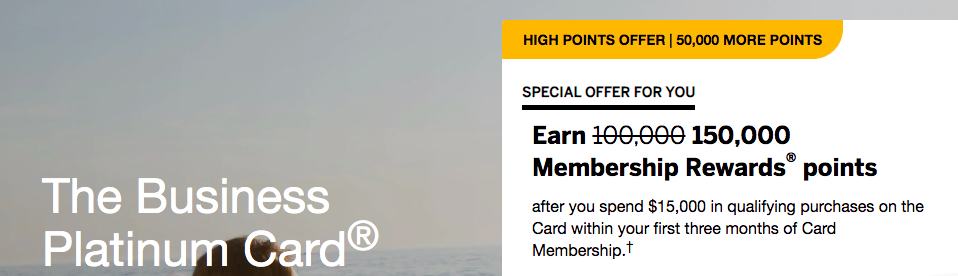

Business Platinum Card: 150,000 Points Welcome Bonus

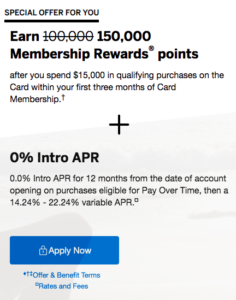

With this offer you’ll earn a welcome bonus of 150,000 Membership Rewards points after you spend $15,000 in the first 3 months of card membership. Moreover, you’ll enjoy an intro APR of 0% for the first 12 months.

Click Here for the 150,000 points + 0% APR Offer

(If the 150,000 points offer doesn’t show up right away, then try opening the offer link in incognito mode or private browsing more and the offer should show up)

WHY SIGN UP NOW?

Now you may ask, why should I sign up now and why not later? If you sign up on Jan 13th or later, this bonus may still stick around but you’ll pay an extra $100 in annual fees.

Business Platinum Card: Multiple Statement Credits

Following are many of the statement credits that this card offers.

AIRLINE FEE CREDIT ($400 VALUE)

You can get the airline fee credit worth $200 right away after you’re approved. Then get another $200 once 2023 begins. That’s already $400 in value for a card that charges a $595 annual fee.

DELL CREDIT ($600 VALUE)

Amex splits the Dell.com credit mid way through the year. So you can get a $200 credit now. Then get another $200 between July and December 2022. Even if you decide to cancel the card, you can still get another $200 in January 2023 even if you decide not to renew the card.

INDEED CREDIT ($450 VALUE)

The Business Platinum Card offers an Indeed.com credit that’s split quarterly with a credit of $90 per quarter. Between now and January 2023, you can use this $90 credit five times, adding up to $450 in value.

ADOBE CREDIT ($300 VALUE)

Amex also offers the Adobe credit similar to the Airline Fee credit, on a calendar year basis. If you sign up for the card now, you’ll get $150 in credits for 2022 and another $150 for 2023, adding up to $300 in value.

CLEAR CREDIT

You can get up to $179 in credits for a Clear membership. You can also use this credit on a calendar year basis and use it once in 2022 and again in 2023.

OTHER CREDITS

TELEPHONE BILL CREDIT ($120 VALUE)

With the Business Platinum Card, you’ll get a $10 statement credit when you charge your wireless telephone bill from a qualifying carrier each month. If you charge your bill each month, you can get up to $120 in credits. Moreover, you’ll get cell phone protection insurance when you simply use your card to pay your phone bill.

CARD BENEFITS

In addition to all the credits mentioned above, you’ll also continue to get some of the amazing benefits that the Business Platinum Card offers.

- Centurion Lounge Access, Delta Sky Club access while flying Delta, Priority Pass Select & more

- Access to Amex’s Fine Hotels & Resorts program

- 35% points back while using Pay with Points with a qualifying Airline

- 5x points on prepaid hotels and flights booked with Amextravel.com

- 1.5 x points on all purchases of $5,000 or more

- Trip cancellation, interruption, delay insurance and lost baggage insurance

- Car rental and loss damage insurance

- Marriott & Hilton Gold elite status

- Fee credit for Global Entry/TSA Pre-check

- Extended warranty & purchase protection

CRUNCHING THE NUMBERS

Given the way this card’s credits are structured, it makes perfect sense to apply now. You can maximize all the calendar year benefits for this year and then also use some of the credits for 2023. If you simply max out all the credits mentioned above, you’ll end up with a value of at least $2,000.

Moreover, you’ll also get a welcome bonus of 150,000 Membership Rewards points. Even if you conservatively value Amex points at 1.5 cents per point, you’ll get a value of $2,250. For a card that charges an annual fee of $595, $4,250 in value is simply fantastic for just keeping the card for the first year.

If you frequent lounges in Amex’s network and use their Fine Hotels & Resorts program, then the value on this card simply keeps adding up. Not to mention the complimentary Gold elite status you get with Hilton and Marriott.

THE PUNDIT’S MANTRA

To play devil’s advocate, let’s assume that you only value the credits at 50% of their value, based on your consumption patterns. Even in that case, you’ll get a value of $1,000 by simply double dipping the credits. Add to that the welcome bonus value of $1,125 and you’ll still end up with a value of $2,125 for a card that charges a fee of $595.

I already have a card. If you were looking to get this card anyway, then there couldn’t have been a better time to get it, especially with the annual fee about to increase and the sweet spot opportunity to maximize calendar year based credits.

APPLY NOW FOR THE 150,000 POINTS OFFER

___________________________________________________________________________________________________________________

Never miss out on the deals, news and travel industry trends. Like us on Facebook, follow us on Instagram and Twitter to keep getting the latest content!

1 comment