Earlier this week, I wrote about how the $400 Hilton Aspire credit works. Last year, American Express refreshed their consumer and business credit cards with Hilton. In case of the Hilton Business card, Amex increased the fee to $195. However, Amex also started offering a credit of $240 annually after making changes to the card. How does this work? Let’s have a look.

$240 credit on the Hilton Business Card

With this limited time welcome bonus offer on the Hilton Business Card, you will earn a bonus of 175,000 Hilton Honors points. You’ll earn the bonus after you spend $8,000 in the first 6 months of card membership. Most people will find the minimum spend easy to meet as one only needs to spend $1,334 each month for a period of six months.

Apply now for the 175,000 points offer

In addition to the $240 credit, you will also get the following benefits:

- Complimentary Gold elite status for simply keeping your card account active (complimentary breakfast outside the US, breakfast credit in the US, room upgrades, 80% bonus points on stays)

- You can earn top tier Diamond elite status after you spend $40,000 in a calendar year

- Complimentary National Car Rental Emerald Club Executive Status for simply keeping your card account active

- No foreign transaction fees

Earning points on spend

This card is great for people who want to put all of their business spend on a single card to earn Hilton Honors points. You will earn:

- 12x Hilton Honors points for each dollar you spend at hotels in the Hilton portfolio

- 5x Hilton Honors points for each dollar you spend on all other purchases (Up to 500,000 Hilton Honors points per calendar year). After that you will earn 3x points on all spend.

$240 credit

Here’s how the benefits works. Like many of Amex’s credits, this credit is divided into four $60 credits each quarter. You earn:

- $60 between January 1 to March 31

- $60 between April 1 and June 30

- $60 between July 1 and September 30

- $60 between October 1 and December 31

Qualifying Charges

Unlike the resort credit on the Hilton Aspire, simply making a booking through the Hilton website will trigger the credit. Unlike the resort credit, you don’t have go looking around for specific properties. As per the terms and conditions, bookings made directly via Hilton qualify.

Basic Hilton Honors American Express Business Card Members can receive up to a total of $60 in statement credits each calendar quarter (January through March, April through June, July through September, and October through December) for up to $240 back annually, for eligible purchases charged directly with a property within the Hilton portfolio on their Card Account, including bookings and incidental charges. For a booking to be eligible for a statement credit, the booking must be made directly through a reservation channel operated by Hilton. Bookings or purchases made through a third party other than Hilton, such as an online travel website, will not be eligible for statement credit(s).

If you’re putting incidental charges on the card, then you must make sure that the establishment is a part of the hotel and that the charge doesn’t code separately.

For incidental charges (including charges made at restaurants, spas, and other establishments within the hotel property) to be eligible for a statement credit, the incidental charge must be charged to your room and paid for with the Hilton Honors American Express Business Card at checkout.

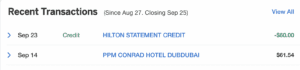

During a recent stay, I decided to try this benefit out and see how it works. I was staying at the Conrad Dubai and decided to put the card on file during check in. During check out, I charged incidentals to the card. During my stay, I used the credit to order in-room dining.

As per the terms and conditions, it can take 8-12 weeks for the credit to post. In my case, the credit posted in 9 days.

Overall, I’ve found this credit pretty easy to use. You don’t have to worry about finding qualifying properties and can simply use the credit while booking a room at any property in the Hilton portfolio each quarter.

The Pundit’s Mantra

I hope this post was able to shed light on how the credit works. In case of the Hilton Business card, it’s really good if you make a few stays with Hilton each year and put a ton of non-category bonus spend on the card. That way, you can max out the 500,000 Hilton Honors points cap each year if your business spends $100,000 each year on the card.

At the moment American Express is offering elevated welcome bonuses on all of their co-branded credit card with Hilton.

| Card Name | Welcome Bonus + Application Link | Minimum Spend Required in 6 months |

| Hilton Honors Card | 100,000 points | $2,000 |

| Hilton Surpass Card | 165,000 points | $3,000 |

| Hilton Aspire Card | 175,000 points + 1 free night certificate | $6,000 |

___________________________________________________________________________________________________________________

Never miss out on the deals, news and travel industry trends. Like us on Facebook, follow us on Instagram and Twitter to keep getting the latest content!