Frequent readers of this blog may have noticed that I usually take a ‘less is more’ approach towards travel. Instead of taking many trips, I prefer taking fewer yet longer trips. When I do take them though, I look to max out in terms of extracting value from the miles and points I use. Free night certificates are a favorite for many in our community. While they offer the opportunity to book some memorable stays, they mostly expire within a year and have certain restrictions. So how does one extract maximum value from them? Let’s have a look at some of the strategies that you can adopt. For the purpose of this blog post, we’ll primarily focus on the three big hotel chains: Hilton, Hyatt and Marriott.

Maximizing value from Free Night Certificates

For brevity, we’ll be using FNC for the rest of the article. In most cases, one earns an FNC as a welcome bonus or for meeting a specific spend threshold on a co-branded hotel credit card. Before we look at how one can maximize value, let’s get the basics out of the way.

Which cards are offering Free Night Certificates?

| Credit Card | When is FNC issued? | Welcome Bonus Offer | Apply Now |

| Hilton Aspire Card | Upon account opening and renewal, another after $30k spend, another after $60k spend in a calendar year | 180,000 Hilton Honors points + 1 free night certificate | Click Here |

| Hilton Surpass Card | $15k spend in a calendar year | 170,000 Hilton Honors points | Click Here |

| Hilton Business Card | $15k spend, another after $60k spend in a calendar year | 130,000 Hilton Honors points | Click Here |

| Marriott Bonvoy Bevy American Express Card | $15k spend in a calendar year | 85,000 Marriott Bonvoy points | Click Here |

| Marriott Bonvoy Brilliant American Express Card | Upon renewal, another after $60k spend | 95,000 Marriott Bonvoy points | Click Here |

| Marriott Bonvoy Business Card | 3 FNCs as a welcome bonus, another after $60k spend, another upon card renewal | 3 free night awards (max 50k points per night) | Click Here |

| Marriott Bonvoy Boundless Card | 3 FNCs as a welcome bonus, another upon renewal | 3 free night awards (max 50k points per night) | Click Here |

| Marriott Bonvoy Bountiful Credit Card | $15k spend in a calendar year | 85,000 Marriott Bonvoy points | Click Here |

| World of Hyatt Credit Card | Upon renewal (Category 1-4) | Up to 60,000 World of Hyatt points | Click Here |

Types of FNCs

Not all FNCs are created equal. For example, Hilton’s free night certificates are uncapped. This means you can redeem an award as long as a standard room is available.

In contrast, Hyatt’s FNCs are based on the room category. Marriott, on the other hand, caps it based on points needed per night.

FNCs are not points

FNCs are different from points redemptions. Some programs (like Marriott) let you add points to an FNC to make for any shortfall. Others like Hilton or Hyatt don’t offer such options.

Limitations

Depending on the hotel chain, FNCs are capped. For example, this welcome bonus from Amex caps the redemption value on this Marriott redemption at 50,000 points per night. However, this welcome bonus on the Hilton Aspire card gives you a free night without any restrictions. All FNCs aren’t created alike. Each has their own unique terms and conditions, depending on the hotel chain and how you earned the FNC.

Expiration Dates

This is the most important part. Unlike your points balance, which you can keep active by buying some candy with your co-branded card or by simply transferring points over, FNCs usually expire in 1 year after issuance.

Extracting Maximum Value from Free Night certificates

Dream Destination

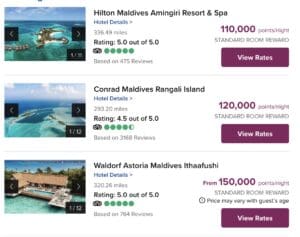

Start by first thinking about where you’d like to travel. What’s your dream destination? For example, we went to the Maldives last year. The price per night was 120,000 Hilton Honors points. I used 4 free night certificates to book a 4 night stay. Had I used points, I would’ve paid a total of 480,000 Hilton Honors points.

In short, using an FNC makes more sense when the points redemption rate or cash rate at the property is really high. In contrast, I’d not use an FNC at a property like the Hampton Inn Chicago Downtown/Magnificent Mile. I’d rather pay 27,000 Hilton Honors points per night.

Availability

The biggest issue with aspirational properties is that they’re mostly sold out during peak season. Since FNCs expire in 1 year, it’s prudent to plan and book well in advance. Also, most FNCs only work if the property has a ‘standard room’ available.

If you wait too close to the expiration date, there’s every chance you’ll struggle to extract maximum value due to lack of availability at popular destinations. You can refer to this handy post by Frequent Miler which goes over certain tools that you can use to track hotel room availability.

Flexibility

You need to be flexible and use points and FNCs wisely. For example, I have decent stash of Hilton FNCs and points. If points rates are low, I book using points and get the 5th night free. If points and/or cash rates are really high, I use my FNCs first.

Depending on the hotel chain specific policies and expiration dates, you really need to be nimble. In most cases, it’s better to use the FNCs first once you start getting closer to the expiration date.

Extending FNCs

In certain cases, you can also request the hotel chain to extend the expiration date for a free night certificate. There have always been exceptions granted, but I’d not recommend this as a strategy as hotel policies can change any moment and the plug can be pulled at any time.

The Pundit’s Mantra

Here’s how I plan my redemptions of free night certificates. Your travel goals and plans may be different, but you can use this as a template.

Step 1: Order my FNCs by their expiration dates.

Step 2: What’s my travel goal? Check FNC redemption availability at those properties. Most importantly, check important things like category restrictions and restrictions on topping up points for any shortfall. Check specific hotel cancellation policies if your plans are still not finalized yet.

Step 3: Compare FNC v/s Cash/points rates. Would I be better off holding on to this FNC for now since the points or cash rates are cheaper?

I usually track all my FNCs in a spreadsheet. I have FNCs with Hilton and Hyatt. If you have multiple co-branded hotel credit cards, it always helps to track them using a spreadsheet and set alerts well in advance of their expiration dates. In addition, I also use tools like Awardwallet which help me track expiration dates for my points and FNCs.

What’s been your favorite redemption using FNCs? Tell us in the comments section.

___________________________________________________________________________________________________________________

Never miss out on the deals, news and travel industry trends. Like us on Facebook, follow us on Instagram and Twitter to keep getting the latest content!