Every now and then, we come across seasonal or limited time credit card offers. You’ll find many of these offers advertised publicly. However, you may have to dig around a bit for others. I frequently use the incognito method to find elevated sign-up bonuses for credit cards. In this post, I’ve also highlighted how you can get highest possible sign-up bonus for a card. I love Amex’s co-branded Hilton card portfolio as it offers me great value. I can swiftly earn ton of points and access elite status and benefits. While scrolling through the Amex website in incognito mode, I just found that all Hilton cards are offering elevated bonuses!

Hilton Sign-up Bonuses

In order to access these bonuses, log into your browser by using the incognito or private mode. This post highlights how you can access elevated bonuses in the incognito mode.

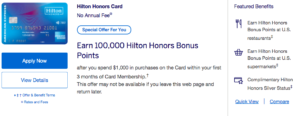

Hilton Honors Card

You’ll earn a welcome bonus of 100,000 Hilton Honors points after you spend $1,000 in the first three months. This card charges no annual fee.

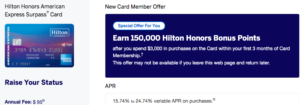

Hilton Honors American Express Surpass Card

You’ll earn a welcome bonus of 150,000 Hilton Honors points after you spend $3,000 in the first 3 months. The card charges an annual fee of $95.

Hilton Honors American Express Aspire Card

You’ll earn a welcome bonus of 150,000 Hilton Honors points after you spend $4,000 in the first 3 months. The card charges an annual fee of $450. You’ll also earn a free weekend night after approval and each year after you renew your card.

The Pundit’s Mantra

While the Aspire card bonus seems to be standard at the 150k + 1 free night level, it’s great to see more points offered on other co-branded cards. If you’re eligible, the personal cards are offering elevated sign-up bonuses. Conversely, the co-branded business credit card is still offering a sign-up bonus of 125,000 Hilton points.

You can access most of these offers by using the incognito mode. As I’ve mentioned earlier, The Points Pundit earns no commission from affiliate links. You can support the blog by using my refer-a-friend link, but only when it offers you an equal or better bonus than other links!

Amex does enforce their once-in-a-lifetime rule to these offers. In essence, Amex won’t give you the sign-up bonus again if you’ve signed up for the card and earned the bonus before.

On the personal front, I keep switching between the no annual fee and the Hilton Aspire card. Many readers report that Amex sends lucrative upgrade offers after you downgrade to the no annual fee card.

Which co-branded Hilton card do you like the most? Tell us in the comments section.

___________________________________________________________________________________________________________________

This travel credit card is one of my favorite hotel credit cards. With this card, you’ll not only earn a free night each year when you renew the card, but If you pair it with this limited time offer, you’ll also earn 25% points back when you redeem your points until October 8, 2020.

You can earn a welcome bonus of 50,000 points when you apply for this card using the link below!

___________________________________________________________________________________________________________________

Never miss out on the deals, analysis, news and travel industry trends. Like us on Facebook, follow us on Instagram and Twitter and get the latest content!

___________________________________________________________________________________________________________________

Disclosure: The Points Pundit receives NO compensation from credit card affiliate partnerships. Support the blog by applying for a card through my personal referral links. This article is meant for information purposes only and doesn’t constitute personal finance, health or investment advice. Please consult a licensed professional for advice pertaining to your situation.