Last month, American Express refreshed both consumer and business versions of their coveted Platinum card. Now, both versions of Platinum cards offer an enhanced $600 Hotel Credit. So how does the $600 Hotel Credit work on the Amex Platinum Card? Let’s have a look.

Enhanced Amex Platinum Card Credit

Let’s start with the basics.

Cards that offer the $600 Hotel Credit

You’ll enjoy this credit on the Amex Platinum Card as well as the Business Platinum Card. Also, it doesn’t matter which type of Platinum card you have. You’ll enjoy the same benefit on cards offered via Morgan Stanley and Charles Schwab as well.

Authorized users can also enjoy this benefit. However, irrespective of the number of authorized users you’ve added, you can only get a maximum of $600 per year in credits. In essence, every additional user doesn’t get their own credit.

Qualifying Bookings

As per the terms and conditions, you need to make a prepaid hotel booking using your card at properties listed in Amex’s Fine Hotels & Resorts Collection or The Hotel Collection. The new terms and conditions exclude points and cash bookings.

Qualifying booking include bookings made through the following channels only:

- Amextravel.com

- The Amex Travel App

- Amex App

- Calling the number on the back of your card

Minimum Stay Requirement

Unlike the requirements on ‘the Edit’ bookings with the Chase Sapphire Reserve, Amex imposes no minimum booking restrictions on the Fine Hotels and Resorts collection. However, bookings made trough The Hotel Collection have to be of two nights or longer.

Fine Hotels & Resorts Collection (FHR)

You’ll get access to this program if you have any version of the consumer Platinum card, the Amex Centurion card or the Business Platinum Card. You do not need to enroll separately as the benefit is automatically active on your card. Also, you can use the benefit as many times as you want, there’s no upper limit. You’ll get access to Fine Hotels and Resorts bookings on the following cards:

- Amex Centurion Card

- American Express Platinum Card (Consumer version)

- Business Platinum Card

- Morgan Stanley Platinum Card

- Charles Schwab Platinum Card

FHR Benefits

In my experience, I’ve found these benefits to be of immense value, especially when room rates are on par with rates offered directly by the hotel. As per the American Express Fine Hotels & Resorts Program website, the following benefits are on offer:

- Room upgrade upon arrival (subject to availability)

- Daily breakfast for two people

- Guaranteed 4 PM late check-out

- Noon check-in (subject to availability)

- Complimentary Wi-Fi

- $100 Credit – applicable toward a Spa/Food & Beverage or other incidentals (varies by property)

- 5x points per dollar spent when you book on Amextravel.com when you book with the Platinum card

Rules & Restrictions

If you book two back-to-back stays at the same property, then the property has the right to treat that as just one stay. In short, for both THC and FHR booking, booking back-to-back stays at the same property wont trigger the benefits again. Also, you can use these benefits for a maximum of three rooms booked with the card. The same rules apply to The Hotel Collection Bookings as well.

Benefits are applied per room, per stay (with a three-room limit per stay). Back-to-back stays booked by a single Card Member, Card Members staying in the same room or Card Members traveling in the same party within a 24-hour period at the same property are considered one stay and are ineligible for additional FHR benefits (“Prohibited Action”). American Express and the Property reserve the right to modify or revoke FHR benefits at any time without notice if we or they determine, in our or their sole discretion, that you may have engaged in a Prohibited Action, or have engaged in abuse, misuse, or gaming in connection with your FHR benefits. Benefit restrictions vary by property.

The Hotel Collection

Unlike with the Fine Hotels and Resorts collection, you need to book a stay of at least two nights with The Hotel Collection for your booking to qualify. Following are the benefits you’ll enjoy when you make a booking with The Hotel Collection:

- Room Upgrade (up to one category, based on availability)

- $100 credit (f&b/spa – varies by property)

- 12 PM check-in based on availability

- Late check out, based on availability

$600 per year, split bi-annually

Like many other credits offered by Amex, this isn’t a set it and forget it type of benefit. With the Hotel credit, you’ll earn $600, but the credit is split half way through the year. You’ll earn:

- A maximum of $300 in credits between January 1 and June 30 during every calendar year

- A maximum of $300 in credits between July 1 and December 31 during every calendar year

Booking date is based on Central Time.

How soon do the credits post?

As per Amex’s official terms and conditions, the credits can take up to 90 days to post. However, in my experience, I’ve usually seen the credits post in 2-3 business days in almost all cases.

Earning Hotel Elite Nights & Bonus Points

You’ll find different data points online about this. However, in my experience, I’ve had no issues in earning both elite night credits and points with both Hilton and Marriott while booking a stay at their properties via the Fine Hotels and Resorts collection. I’ve been able to earn points as well as elite night credits, in addition to enjoying elite perks without running into any issues whatsoever.

5x Points

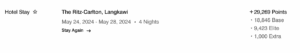

The great thing is that in addition to the credit, you’ll also earn 5x points on the dollar value of your booking made via AmexTravel.com For example, let’s say, the grand total for your booking is $1,000. Since it qualifies for the credit, you’ll get a statement credit of $300 right away and also earn 1,000 x 5 = 5,000 Membership Rewards Points for your purchase.

The Pundit’s Mantra

This credit may not be the right fit for you if the hotel rates at your desired destination are very high. Also, you must compare FHR/THC rates with other channels before you book. There’s no point in paying extra for these benefits, if you’re getting cash rates from other channels that are significantly cheaper in the first place.

As someone who has carried the Amex Platinum Card in his wallet for many years, I’ve found the Hotel credit one of the easiest credits to use. With a total of $600 each calendar year now, this only enhances the value that the card offers for my style of travel. I do a ton of International travel, so I find it very easy to find hotels around the world in the $200-$300/night range. Therefore, I find it very easy to use the benefit at least 3-4 times a year. With this benefit split bi-annually, I should be able to max out the $600 in credits with minimal effort.

___________________________________________________________________________________________________________________

Have an interesting travel story? Subscribe to my podcast and join the conversation

___________________________________________________________________________________________________________________

New Credit Card Offers

American Express Business Credit Cards

- Earn 200,000 Membership Rewards points with the Business Platinum Card

- Earn 150,000 Membership Rewards and enjoy a 0% intro APR on the Business Gold Card

Chase Sapphire Cards

- Earn 125,000 bonus points with the Chase Sapphire Reserve Card

- Earn 200,000 bonus points with the Chase Sapphire Reserve Card for Business

___________________________________________________________________________________________________________________

Never miss out on the deals, news and travel industry trends. Like us on Facebook, follow us on Instagram and Twitter to keep getting the latest content!

I just booked a hotel collection stay for 2 nights in Seoul. Total was $427 so only $127 w the $300 credit. Then I get a $100 food/beverage comp and free breakfast (benefit at this hotel and not guaranteed for hotel collection). Basically I get a free 2 nights since the breakfast and food/beverage credits covers the $127.

I get great value from this (unsure of Edit w my CSR since much more limited hotel options). If understand cheap people that never want to pay a dime whining but frankly the Platinum card (or CSR) aren’t for you. I travel internationally multiple times a year, like to stay in 4/5 star hotels and eat in higher end restaurants so the revisions to the Platinum card are great for me. If they don’t fit drop it but understand it is your lifestyle and budget – not the card

The fact that Amex keeps increasing the AF signifies exactly that – they want customers who are okay with a $900 AF.

It’s “easy to use” for those already inclined to do cash bookings via these hotel programs.

It’s not so “easy to use” for those who strive to only book hotel stays using points and avoid “coming out of pocket”.

With these kind of credits, it’s nearly impossible to use 100% of the benefit and avoid coming out of pocket on top of it.

That’s precisely what the last couple of paragraphs of the article.are all about.