If you’ve been in the miles & points space for long enough, I’m pretty sure at some point you’ve been guilty of this mistake. I’ve been in this space for over 13 years and I’d be the first to put my hand up and say that I’ve been guilty of doing this a few times.

This Miles & Points Mistake has real Consequences

If you’ve been in this community for long enough, you hold on to your miles & points like it’s your favorite pet or a near and dear one. In our community, you often hear people brag about their massive points balance. Some talk about their amazing redemptions at aspirational properties, while other wax eloquent about thier six figure or even seven figure points balance in particular currency.

Unlike a bank account that earns interest on savings, miles & points balances, unfortunately, don’t.

Consumer Psychology

As travel enthusiasts, we always want that safety padding. When we feel like booking a trip, you always want to have ‘enough’ miles in your account. However, we make the mistake of hoarding too many miles & points in our accounts.

Devaluations

We keep ‘building our balances’ and then the inevitable happens. A devaluation. Most recently, I wrote about Hilton’s unannounced devaluation and how it really stung a few people. In my opinion, loyalty programs that announce devaluations in advance are still giving their customers enough notice. However, these unannounced devaluations are just outright daylight robbery. Also, in case of many of these devaluations, people often find out that they happened because some blogger or an eagle eyes reader spotted it instead of the loyalty program actually announcing it.

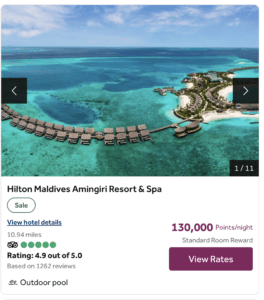

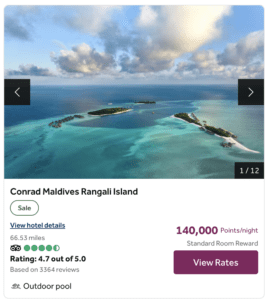

This is what you call a rug pull. I stayed at Conrad Maldives in 2022. Back then, the price was 120,000 points per night. That a 17% increase right away. I stayed at the Hilton Amingiri Maldives a few weeks after it had just opened in late 2023. Back then, the price per night was 110,000 points per night. That’s now up by 18%, to 130,000 points per night.

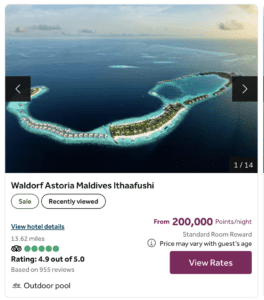

Let’s take the example of the elusive Waldorf Astoria Maldives. On most date, you’d find that the availability using points is minimal, even during off season. Initially, after the hotel had just opened, the property cost 150,000 points per night. We’ll that’s just 33% more expensive now, a whopping 200,000 Hilton Honors points per night.

Earn & Burn

So where does that leave us? We’ll, how much points we like to have in our accounts as a ‘safety padding’ is something very subjective and differs from person to person. Some people just love to earn, burn and churn. Earn points, redeem them, then apply for a card and earn them again. Other like to hold on longer, especially if they make only a few trips per year.

Convert to Cash?

Is this an option? Well, it depends. In most cases, you’ll only get one cent per point. The only time I’ve converted points into cash is when I’ve used my Charles Schwab Platinum Card to ‘pay’ for a trip and then redeem Amex points at a 1.1 cents per point value to account for it. However, I only do that if there’s no better alternative available to redeem points at a rate higher than 1.1 cents per point.

Fewer but longer

Like many others, I’ve evolved from taking multiple short trips to taking fewer but longer trips, especially while traveling with a kid. In my case, yes, I take fewer trips. However, I make sure my hotel stays are longer and that I mainly look for premium cabin space. That way I’m always burning enough miles and ensuring that I’m not leaving too many on the table. Also, while traveling with a kid, it makes my trips more comfortable, especially on flights longer than 6 hours.

The Pundit’s Mantra

So what’s the ideal points balance to have? It depends on the person. But, the one thing you must not do is just keep building a balance. There’s no award that you’ll get for reaching 1 million or 2 million in your miles & points balances. On the contrary, you’re more likely to get burned when a program like Hilton pulls the rug suddenly.

How do you plan your miles & points earn and burn strategy? Do you have a set number before you start applying for cards again to rebuild your balances? Tell us in the comments section.

___________________________________________________________________________________________________________________

Never miss out on the deals, news and travel industry trends. Like us on Facebook, follow us on Instagram and Twitter to keep getting the latest content!