Disclosure: I receive NO compensation from credit card affiliate partnerships. Support the blog by applying for a card through my personal referral links.

Chase offers an impressive credit card portfolio, especially for those who love to travel. Most importantly, Chase’s Ultimate Rewards points continue to be the favorite points currency for many readers, given Chase’s valuable points transfer partners. However, Chase has put application restrictions in place. Chase’s 5/24 rule continues to be a roadblock for many frequent travelers looking to rack up miles and points.

Also Read: How to maximize earning Chase Ultimate Rewards Points

Chase 5/24 Bypass

Ever since Chase introduced the 5/24 rule, many readers have been locked out of Chase credit cards for a while. In simple words, Chase won’t approve you for most of their credit cards if you’ve had 5 or more credit cards in the last 24 months.

However, Chase has targeted certain readers with credit offers even when they were over the 5/24 limit. We’ve seen data points where readers have been sent targeted offers via mail. In certain cases, Chase has shown ‘black star’ offers to users after they log into their Chase accounts.

Also Read: The one thing that you must know about Chase’s 5/24 rule

My Offer

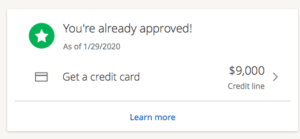

I was surprised to see one such offer when I logged into my Chase account last night. After logging in, I saw the offer on the right hand side of the screen. The offer showed up in spite of the fact that I’m over 5/24.

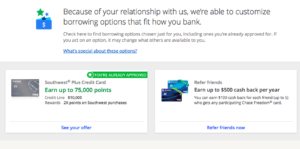

I clicked on the offer in order to see what shows up.

Given that I either have or have had most of Chase’s prominent travel credit cards, I was expecting to see either the standard bank account and referral bonuses show up or an application for a non-travel credit card like Chase Slate . However, I was pleasantly surprised when I saw an offer for a card that was truly a travel credit card!

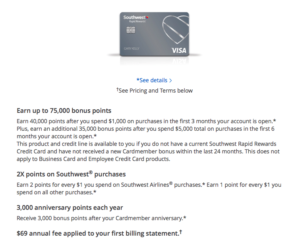

Chase’s offer was for the Southwest Rapid Rewards Plus Credit Card. With this offer, I could earn a total of 75,00 bonus Rapid Rewards points. Here’s the full text of the offer:

Earn 40,000 points after you spend $1,000 on purchases in the first 3 months your account is open.*

Plus, earn an additional 35,000 bonus points after you spend $5,000 total on purchases in the first 6 months your account is open.

The Pundit’s Mantra

I’ve never received one of Chase’s ‘black star’ offers or any targeted mailers. However, this is the first time I’ve received a green star offer with a pre-assigned credit limit. If you are over 5/24, then you should probably just log into your Chase account every now and then in order to see if Chase has targeted you for any such offers.

Have you received any such offers from Chase off late in spite of being over 5/24? Let us know in the comments section.

___________________________________________________________________________________________________________________

Are you looking to earn a great deal of Ultimate Rewards points? Then you can apply for the Chase Ink Business Preferred Card. You’ll get a welcome bonus of 80,000 Ultimate Rewards points! (Chase’s 5/24 rule applies to this card)

Never miss out on the best miles/points deals. Like us on Facebook, follow us on Instagram and Twitter to keep getting the latest content!

I got a UA Milage+ offer and jumped on it 🙂

Hi Bill,

That’s fantastic! Enjoy the 60k bonus 🙂

I doubt i will get any offers. They already have given me so much credit line. Bunch of idiots. Why give so much credit line in the first card and then act all defensive for the next ones because they don’t want to increase risk exposure.

I’m guessing that the algorithms probably don’t factor in that fact that someone may apply for 4-5 credit cards. Most people carry 1 or 2. Have you tried moving around credit limits in order to get approved for a card?