Card issuers offer retention bonuses to keep your business for yet another year. Over the last few years, I’ve written frequently about retention offers and spelled out my success stories and failures in getting one. At th emoment, there’s a lot of buzz with data points suggesting that some cardholders are getting a massive $400 retention bonus to keep their Chase Sapphire Reserve card open. What’s really going on and what are the odds of you getting one?

Chase Sapphire Reserve Retention Offer

A few days back, I had written in detail about this retention offer. Now, it seems like more data points are surfacing where customers are saying that they received $400 as a statement credit to keep the card. However, it seems like we need to clarify a few things here. Firstly, let’s look at the factors that may impact the kind of retention offer a card issuer may offer you:

- The amount of spend you put on the card annually

- Your prior history with the issuer

- How long you’ve kept that card open

If you scour the internet, you’ll see many people saying that they tick all the boxes above. They had spent a lot of money on the card, had a great history with Chase and had carried the Chase Sapphire Reserve card for many years.

However, Chase still didn’t offer them any retention bonus. So what’s going on here?

The truth is that there’s no guarantee even if you satisfy all the factors mentioned above. Beyond a certain point, it has got to do with the issuer’s internal policies, budgets and sometimes, just your luck. So there’s no guarantee that because X gets it, Y will too or because A didn’t get it, B won’t either.

The Pundit’s Mantra

The reality is that, beyond the obvious factors like spend, prior history and the time your card is open, we don’t know the exact formula that an issuer may have to offer or deny you a retention bonus.

When you approach a card issuer for a retention offer, always keep an open mind. Over the years, I’ve received some amazing retention offers for cards on which I’ve barely put any spend. On the contrary, issuers have refused to offer a retention bonus for cards on which I’ve put a lot of spend. Beyond the three factors listed in this article, there are other factors that the issuers obviously want to keep secret. The story isn’t different in the case of the Chase Sapphire Reserve as well. It doesn’t hurt to ask, but don’t expect that you will get the offer. As with most other things in this space, your mileage may vary.

What has your experience been like over the years while requesting a retention bonus from card issuers? Tell us in the comments section.

___________________________________________________________________________________________________________________

___________________________________________________________________________________________________________________

Credit Card Offers

American Express Business Credit Cards

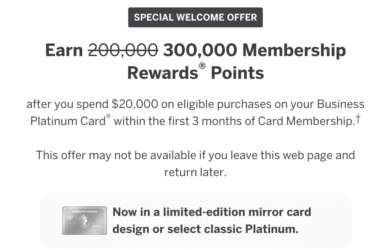

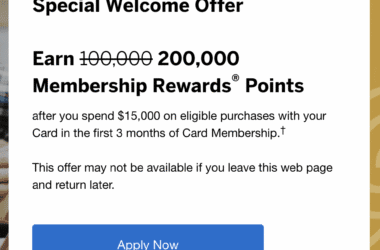

- Earn 200,000 Membership Rewards points with the Business Platinum Card

- Earn 150,000 Membership Rewards and enjoy a 0% intro APR on the Business Gold Card

Chase Sapphire Cards

- Earn 125,000 bonus points with the Chase Sapphire Reserve Card

- Earn 200,000 bonus points with the Chase Sapphire Reserve Card for Business

___________________________________________________________________________________________________________________

Never miss out on the deals, news and travel industry trends. Like us on Facebook, follow us on Instagram and Twitter to keep getting the latest content!

I was a 5-year cardholder with lower spend and when I called to cancel 7 months before my renewal date, because of their requirements, I was offered a $300 statement credit offer to stay until that date with no conditionsto renew later! I took the offer!!

Is this true for biz card as well or just the consumer version?

As a data point I find that in 2025 Chase is more generous with retention offers than Amex (across multiple cards), reversing a trend from 2024.