Last week, we saw numerous articles discuss the United Airlines devaluation in detail. United Airlines essentially devalued their miles further without making any announcement or providing any notice to customers. While this news deserves a lot of coverage, there’s one point that has slipped under the radar. Given that Chase doesn’t have a lot of unique travel partners barring Hyatt and United, where does this devaluation leave our Chase points?

Chase Points Devaluation

I see as this as a quasi devaluation of the Chase Ultimate Rewards program. If you look at all the major airlines in the US, Amex points transfer to Delta and Chase Ultimate Rewards points transfer to United. If you look at the hotel chains, you have the big 3. Amex and Chase Ultimate Rewards points transfer to Marriott. Only Amex points transfer to Hilton at a 1:2 ratio. Which leaves Hyatt. Chase points transfer to Hyatt at a 1:1 ratio. That’s pretty much how I plan to use my Ultimate Rewards points going forward

So what’s the issue here?

The issue here is that of having a major unique transfer partner. Now that United has devalued, I’m pretty much looking at using my Ultimate Rewards points only to transfer to Hyatt. Overall, this leaves Hyatt as the only unique transfer partner worth redeeming points with, since I don’t have any Bilt points. Have a look at this chart comparing the major points transfer partners and you’ll get a gist of what I’m hinting at.

| Chase Ultimate Rewards | Amex Membership Rewards |

| Airline Partners | Airline Partners |

| Aer Lingus AerClub | Aer Lingus AerClub |

| Air Canada Aeroplan | AeroMexico |

| Air France/KLM Flying Blue | Air Canada Aeroplan |

| British Airways Executive Club | ANA |

| Emirates Skywards | Avianca LifeMiles |

| JetBlue TrueBlue | British Airways Executive Club |

| Singapore Airlines KrisFlyer | Cathay Pacific |

| Southwest Airlines Rapid Rewards | Delta Air Lines |

| United MileagePlus | Emirates Skywards |

| Virgin Atlantic Flying Club | Etihad Airways |

| Iberia Plus | Flying Blue Air France/KLM |

| Hawaiian | |

| Iberia Plus | |

| JetBlue TrueBlue | |

| Qantas | |

| Singapore Airlines KrisFlyer | |

| Virgin Atlantic | |

| Hotel Partners | Hotel Partners |

| World of Hyatt | Choice Privileges |

| IHG Rewards Club | Hilton Honors |

| Marriott Bonvoy | Marriott Bonvoy |

- You can now also convert your Bilt points into World of Hyatt points at a 1:1 ratio.

- This means that you’re left with three unique transfer partners: IHG Rewards Club, Southwest and United MileagePlus.

After this United devaluation, I’d argue that one doesn’t really have a reason to keep stacking up points with Chase Ultimate Rewards unless they want to specifically use them with the 4 programs highlighted above. If you aren’t loyal to any of the programs above, then you could simply use your Chase Sapphire Preferred or Reserve cards to redeem your Chase Ultimate Rewards points at 1.25 cents per point or 1.5 cents per point respectively.

My Strategy

I plan to use my Chase Ultimate Rewards balance to book Hyatt stays going forward. I don’t stay with IHG or fly Southwest. If I need to fly Star Alliance, I have multiple options (ANA, Avianca LifeMiles, Air Canada Aeroplan, Singapore Airlines) with Amex Membership Rewards from a points transfer perspective if I’m looking to fly United or its Star Alliance partners.

My Amex points balance is significantly higher than my Chase points balance. I plan to use my Amex points to book flights by transferring to their airline partners or transfer to Hilton Honors whenever there’s a transfer bonus.

The Pundit’s Mantra

How do you see this sudden devaluation by United MileagePlus? I’ve never been loyal to United. However, I love staying at Hyatt properties. Given that I have a substantial stash of points with both Chase and Amex, I pretty much plan to use my Ultimate Rewards points to transfer to Hyatt going forward.

I love transferable points currencies as they give you a lot of options while redeeming. However, what happens to the value of the entire program when one of the unique partners keeps devaluing their miles or points?

How does this United devaluation affect the way you value your the Chase Ultimate Rewards program? Do you significantly plan to change the way you use your Chase Ultimate Rewards points going forward? Tell us in the comments section.

___________________________________________________________________________________________________________________

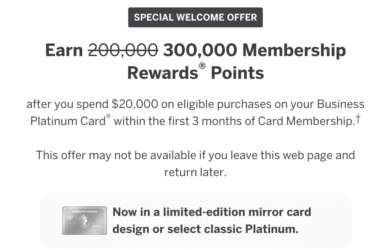

Highest Ever Welcome bonus for this card!

For a card that charges an annual fee of $150, you can earn 60,000 points + $200 with a single welcome bonus. Click on the link below to find out more…

Click Here for this limited time offer

___________________________________________________________________________________________________________________

Never miss out on the deals, analysis, news and travel industry trends. Like us on Facebook, follow us on Instagram and Twitter and get the latest content!

I have about equal amounts of Ultimate rewarads and Amex rewards.

About 1m each. Lately I’ve been finding more occasions to use the points

to “buy” tickets with points. 1.5 with Chase and 35% rebate with Amex. it’s

costing fewer points than if I transferred to the airline. So, I value Chase slightly

higher in this regard. Yeah and I was unhappy with the United devaluation, but

all points are constantly heading in that direction.