American Express is out with brand new welcome bonuses on their co-branded credit cards with Hilton Honors. With these credit card bonuses, you can earn up to 175,000 Hilton Honors points. However, in light of the recent devaluations by Hilton Honors over the last few weeks, do these offers carry the same value?

How I redeemed Hilton points for a value of 0.92 cents per point!

New Credit Card Bonuses with Amex & Hilton Honors

American Express offers a total for 4 credit cards with Hilton Honors, 3 on the consumer side and one on the business side. Here’s a list of current welcome bonuses:

| Card Name | Welcome Bonus Offer | Annual Fee |

| No Annual Fee Hilton Honors Card | 100,000 points | $0 |

| Amex Hilton Honors Surpass Card | 155,000 points | $150 |

| Amex Hilton Honors Aspire Card | 175,000 points | $550 |

| Hilton Honors Business Card | 175,000 points | $195 |

On the surface, these welcome bonuses look great, but are they really that great? Let’s have a look.

Recent Devaluations

Over the last few weeks, Hilton has done two unannounced devaluations. In this post, I highlighted how Hilton’s devaluations have made their free night certificates more valuable. This essentially means that several aspirational properties are now even more expensive when you look to book with points. Your best bet would be to instead book a standard room at the property by using a free night certificate. Here are a few examples of the absurd increase in prices:

- Waldorf Astoria Cabo – From 190k points to 250k points/night

- Conrad Tokyo – From 100k points to 130k points/night

- Roku Kyoto – From 120k points to 140k points/night

- Conrad Singapore Marina Bay – From 70k points to 90k points/night

- Conrad Hong Kong – From 70k points to 85k points/night

- Waldorf Astoria Maldives now a massive 250k points/night

- Conrad Maldives Rangali Island now up from 130k to 180k points/night

- Waldorf Astoria Amsterdam – From 120k to 150k/points/night

- Waldorf Astoria Seychelles – From 150k to 200k points/night

- Waldorf Astoria Grand Wailer – From 120k to 160k points/night

Aspirational Stays v/s Others

Beyond the points v/s free night certificate debate, one must understand that not everyone is looking to book a stay at an aspirational property. If you’re someone who can find good use of points at the property that you’re looking to book, then these bonuses make great sense. However, if you’re looking to book a stay at an upscale property, then the Hilton Aspire Card is your best bet.

Other Options

Let’s say that you don’t want to spend $550 to get a Hilton Aspire Card. However, you still want to book a stay an aspirational property in the future. You can opt for the Hilton Surpass Card. You will earn a free night certificate, but only after you put $15,000 in spend on the card!

Bear in mind that these elevated points offers are valid until Jan 14, 2026. Every year, Amex does run promos when we see free night certificates being offers as part of the welcome bonus on the Hilton Surpass Card and the no annual fee Hilton Honors card as well. So, if you can wait and that’s how you’re looking to travel, then those cards might turn out to be better options compared to the Aspire card.

The Pundit’s Mantra

If you’re someone chasing a stay at an upscale Hilton property, then you’d be better off going after free night certificates than points. When it comes to points, Hilton Honors points often yield anywhere between 0.3-05 cents per point. If you’re lucky and tactful, you can often get a lot more value from them.

What do you think about these new Hilton credit card bonuses by Amex? Tell us in the comments section.

___________________________________________________________________________________________________________________

Have an interesting travel story? Subscribe to my podcast and join the conversation

___________________________________________________________________________________________________________________

New Credit Card Offers

American Express Business Credit Cards

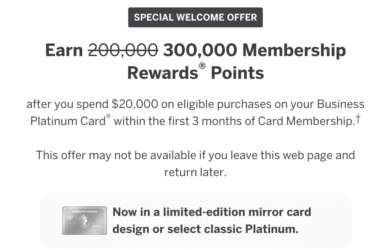

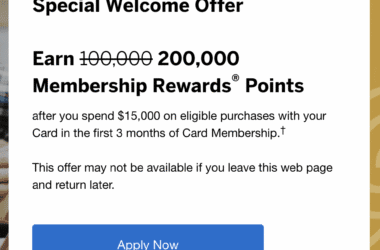

- Earn 200,000 Membership Rewards points with the Business Platinum Card

- Earn 150,000 Membership Rewards and enjoy a 0% intro APR on the Business Gold Card

Chase Sapphire Cards

- Earn 125,000 bonus points with the Chase Sapphire Reserve Card

- Earn 200,000 bonus points with the Chase Sapphire Reserve Card for Business

Co-branded Delta SkyMiles cards

- No annual fee for the first year, earn 80,000 bonus miles with the Delta SkyMiles Gold American Express Card

- Earn 90,000 bonus miles with the Delta SkyMiles Platinum American Express Card

- Earn 125,000 bonus miles with the Delta SkyMiles Reserve American Express Card

- No fee for the first year, earn 90,000 bonus miles with the Delta SkyMiles Gold Business American Express Card

- Earn 100,000 bonus miles with the Delta SkyMiles Platinum Business American Express Card

- Earn 110,000 bonus miles with the Delta SkyMiles Reserve Business American Express Card

___________________________________________________________________________________________________________________

Never miss out on the deals, news and travel industry trends. Like us on Facebook, follow us on Instagram and Twitter to keep getting the latest content!

It looks like Tokyo, Singapore and Hong Kong are the best value looking at your list of point escalations. I stayed at the St Regis in Bangkok for less than 50,000 points a night 2 years ago. Asia is still the best value.

Agree, mid tier more attractive now. Asia provides some great opportunities, in most cases.