The American Express Platinum card polarizes a lot of opinions in the miles and points space. Some really love it, while other just scoff at how complicated it has become. To add to the complications, Amex refreshed the Amex Platinum Card back in September and added a lot of new credits and benefits. However, they also increased the annual fee to $895. Moreover, the card’s welcome bonus is also variable now.

Amex Platinum Card: Avoid These Low Bonus Offers

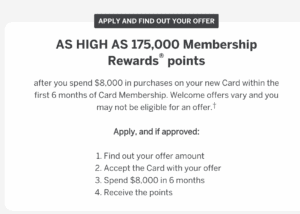

As per this welcome bonus, you need to enter your details and then Amex will show you your customized offer. As per Amex’s website, you can earn up to 175,000 Membership Rewards points. Earlier, we saw some date points that a lot people were seeing offers around the 80,000 Membership Rewards points mark. I already have the card, so I am not able to check these offers.

Click here to check your offer: Up to 175,000 points

As per Reddit, one user pointed out that they saw an offer even lower. The offer was for a measly 50,000 Membership Rewards points.

“I’ve been trying to get a plat for the past month, submitted 1-2 applications every week and always withdrew immediately since I was only getting 80k. Lo and behold I get hit with this offer after trying safari incognito through resy. Crazzy since I’m also getting a 50k for 2k upgrade offer on my gold. Should I just hold off on applying for a couple weeks hoping I get a targeted offer or just keep trying?”

The Pundit’s Mantra

Firstly, this is a really low offer. Secondly, you will find upgrade offers that offer 50k points often showing up on your account. Thirdly, for an offer worth just 50,000 points, $8,000 is a pretty high spend threshold to meet in six months. Usually, you see such higher spend requirements associated with offers much higher than just 50,000 points.

Also, there’s one primary reason that you need to avoid these low offers. Amex has a once in a lifetime rule for welcome bonuses. In essence, what it means is that if you’ve received a welcome bonus on the card before, you’re not eligible to receive the bonus again. As per multiple data points, that span can be anywhere between five to seven years.

If you love earning miles and points through welcome bonus offers, the last thing you’d want to do is to shoot yourself in the foot by signing up for a lowball offer and locking yourself out of that offer for the card product for a very long time.

Which offer pops up for you when you attempt to apply for the Amex Platinum Card? Tell us in the comments section.

___________________________________________________________________________________________________________________

___________________________________________________________________________________________________________________

Credit Card Offers

Marriott Bonvoy

- 3 Free Nights on offer with the Marriott Bonvoy Business Card by American Express

- Earn 5 Free Nights & $100 in credits with the Marriott Bonvoy Boundless Card by Chase

- Pay No Annual Fee & Earn 2 Free Nights with the Marriott Bonvoy Bold Card by Chase

American Express Business Credit Cards

- Earn 200,000 Membership Rewards points with the Business Platinum Card

- Earn 100,000 Membership Rewards points with the Business Gold Card by American Express

Chase Sapphire Cards