The Amex Platinum Card was refreshed yet again before the end of 2025. American Express enhanced the hotel credit benefit and increased it to $600, split half way through the calendar year. In this post, I did a deep dive on whether the hotel credit is really worth it and how Amex’s rates compare to direct bookings with hotels. For an upcoming trip, I completed another booking via Amex’s Fine Hotels & Resorts Collection (FHR). Here’s a short account of my experience of using the hotel credit benefit in 2026.

Amex Platinum Card: Hotel Credit Benefit

After Amex refreshed the personal and business versions of their coveted Platinum cards, Amex added the same $600 hotel credit to the Business Platinum card as well. Coming back to my booking, I had to book just one night using FHR for an upcoming trip to Hong Kong this summer. I had already booked a stay for 4 nights at the Ritz Carlton Hong Kong (3 nights using Marriott Bonvoy points + 1 free night certificate thanks to the Amex Marriott Bonvoy Brilliant Card). I added one more night via Amex FHR to make it a 5 night stay for the month of May. We’ll be flying Cathay Pacific in Business Class during our trip – more on that in future posts.

How the Hotel Credit Works

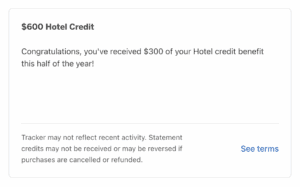

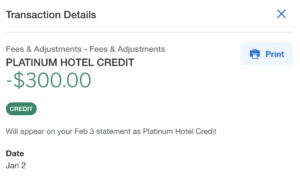

Once you make a purchase, you’ll see that usually within a day, your benefit tracker shows that you’ve used the credit. That’s a sign that your actual credit will show up on your statement very soon.

The terms and conditions state that it may take up to 90 days for the credit to post to your account.

“Statement credits are typically received within a few days, however it may take 90 days after an eligible prepaid hotel booking is charged to the Card Account. Eligible bookings must be processed before June 30th, 11:59PM Central Time, to be eligible for statement credits within the January to June benefit period, and December 31st, 11:59PM Central Time to be eligible for statement credits within the July to December benefit period. American Express relies on the merchant’s processing of transactions to determine the transaction date. If there is a delay in the merchant submitting the transaction to us or if the merchant uses another date as the transaction date then your purchase may not earn the statement credit benefit for the benefit period in which you made the purchase.”

However, in my experience, the credit has usually posted in 1-2 business days.

Here’s a quick timeline of how the credit worked out for me:

- Date of Purchase: Jan 1, 2026

- Date the benefit tracker moved: Jan 2, 2026

- Date the credit posted: Jan 2, 2026

The Pundit’s Mantra

Overall, the Hotel Credit benefit continues to be one of my favorite benefits on the Amex Platinum Card. It’s also one of the primary reasons why I’ve kept the Platinum card open for many years. Also, thanks to the benefit, I’ve been able to experience some really upscale properties over the years, be it the magnificent Lake Palace Udaipur, the Ritz Carlton Reserve property in Krabi, the Ritz Carlton Langkawi, Waldorf Astoria Bangkok, Four Seasons Mumbai and many more.

How do you plan to use your hotel credit benefit in 2026? Tell us in the comments section.

___________________________________________________________________________________________________________________

___________________________________________________________________________________________________________________

Credit Card Offers

American Express Business Credit Cards

- Earn 200,000 Membership Rewards points with the Business Platinum Card

- Earn 100,000 Membership Rewards points with the Business Gold Card by American Express

Chase Sapphire Cards

- Earn 125,000 bonus points with the Chase Sapphire Reserve Card

- Earn 200,000 bonus points with the Chase Sapphire Reserve Card for Business

___________________________________________________________________________________________________________________

Never miss out on the deals, news and travel industry trends. Like us on Facebook, follow us on Instagram and Twitter to keep getting the latest content!