Some Amex Platinum Card holders are receiving a courtesy credit from American Express. That and more as we recap some of the stories form the week gone by…

Amex Platinum Card: $200 Courtesy Credit Added for Eligible Cardholders

American Express recently announced a massive refresh of the Amex Platinum Card in September. Some cardholders, who were unable to use the Hotel Credit benefit are seeing a nice courtesy credit applied to their account by American Express. This is a fantastic move as it may work very well to retain customers for one more year.

Why now is a great time to get the Amex Platinum Card

The Amex Platinum Card has a lot of different credits split across various timeframes. Therefore, if you time the application correctly, then you can double or in this case, even triple dip many of the credits on offer. This post explains how you can get anywhere between 2x to 3x value compared to the massive annual fee your’e paying on the Amex Platinum Card.

30% off on select Singapore Airlines Award tickets!

Singapore Airlines is back with their Spontaneous Escapes for this month. Similar to previous deals, these deals also seem to be highly restrictive as there plenty of blackout dates and route restrictions.

American Express adds a new requirement for adding authorized users…

I haven’t done this for many years, but as per some data points, this now seems to be a hard requirement if you’re looking to add someone as an authorized user to one of your American Express cards.

How loyalty programs trick you into spending more

We love our miles and points. However, there’s a lot that goes behind the scenes. Overall, as we constantly engage with travel loyalty programs, are we falling into a trap? In essence, are these programs making us spend more than we should? In this post, I examine some of the common tricks that brands often pull on customers and what steps you need to take in order to ensure that you come out ahead in the long run.

What’s in my wallet? Here are the travel credit cards that I’m currently carrying…

In the miles and points space, one of the commonly asked questions is: “Which card should I get next?”. So, every now and then, I spell out and list which cards I currently have and why. My strategy is always evolving, but is currently focused on earning more transferable points, especially in the American Express Membership Rewards and Chase Ultimate Rewards points ecosystems.

___________________________________________________________________________________________________________________

Subscribe to my YouTube channel for the latest in miles, points & travel…

___________________________________________________________________________________________________________________

New Credit Card Offers

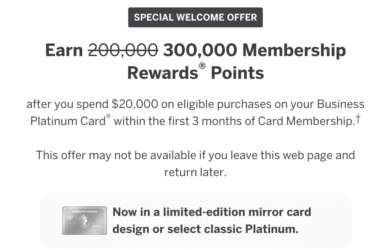

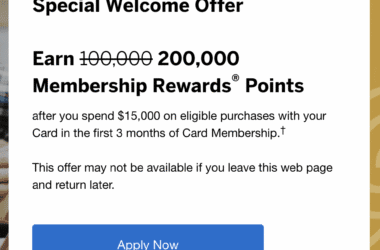

American Express Business Credit Cards

- Earn 200,000 Membership Rewards points with the Business Platinum Card

- Earn 150,000 Membership Rewards and enjoy a 0% intro APR on the Business Gold Card

Chase Sapphire Cards

- Earn 125,000 bonus points with the Chase Sapphire Reserve Card

- Earn 200,000 bonus points with the Chase Sapphire Reserve Card for Business

___________________________________________________________________________________________________________________

Never miss out on the deals, news and travel industry trends. Like us on Facebook, follow us on Instagram and Twitter to keep getting the latest content!