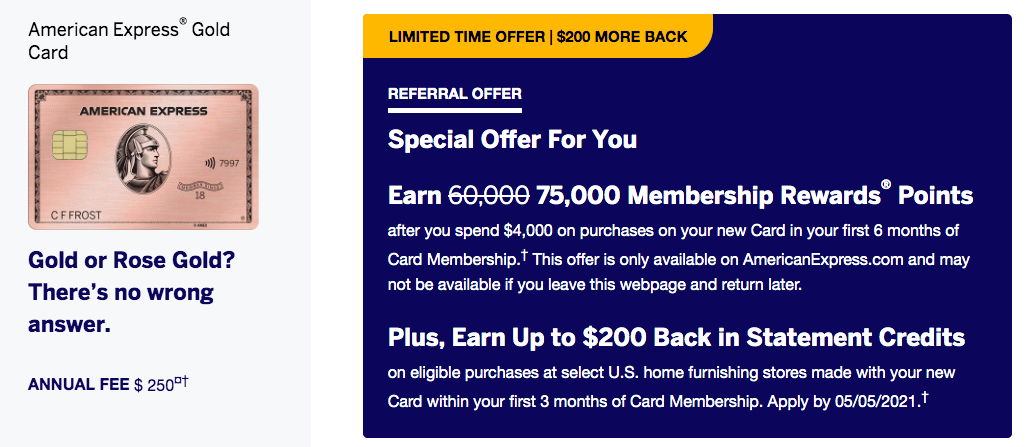

Update: Just a couple of days back, I wrote (in the post referenced below) about the fantastic Amex Gold card bonus offering 75,000 Membership Rewards points. Now, Amex has sweetened the deal with a new offer. You can now earn a welcome bonus of 75,000 points. Additionally, you’ll earn a statement credit of $200 when you spend at select U.S home furnishing stores.

As per the terms and conditions, eligible purchases include qualifying purchases in-store, online and via mobile app at The Home Depot, Lowe’s, The Container Store, Bed Bath & Beyond, Crate and Barrel, Crate and Kids, CB2, Anthropologie and Terrain.

What’s even better is that if you’re not eligible for the Amex Gold Card, then there are similar offers on other Amex cards with an additional $200 credit for purchases at furnishing stores. For example, with the Amex Green Card, you can get a welcome bonus of 50,000 points and an additional $200 in statement credits.

(You can open the link in incognito or private browsing mode if the offer doesn’t show up right away)

___________________________________________________________________________________________________________________

Over the last few years, I’ve frequently written about the incognito mode being one of the best ways to get an elevated welcome bonus for credit cards. In this post, I’ve highlighted the different ways in which you can get the highest possible welcome bonus for a card, each time you apply. Similarly, I found something really interesting while casually browsing the Amex website in incognito mode. A whopping 75,000 points welcome bonus on the Amex Gold card!

Amex Gold Card

You should be able to pull up the offer by clicking on this link in incognito or private browsing mode. This offer is available publicly and doesn’t offer me any sort of compensation if you get approved. What’s great about this offer is that you have some extra time to meet minimum spend as well. Also, I was able to pull this offer up while using Chrome in incognito mode. You can view the full terms and conditions of the welcome bonus here.

With this offer, you’ll earn a welcome bonus of 75,000 Membership Rewards points after you spend $4,000 in the first 6 months. If you value Membership Rewards points, then this is a fantastic offer, since the usual public offer is a measly 35,000 points. However, Amex does bump up the offer up to 60,000 points every now and then.

With the card, you’ll earn the bonus points in the following categories:

- 4x points per dollar you spend on dining (includes takeout and delivery)

- 4x points per dollar you spend on groceries (max $25,000 in purchases per year, then 1x)

- 3x points on flights you book directly with an airline or on amextravel.com

- 1x points on all other purchases

In addition, for a card that charges an annual fee of $250, it offers some really valuable credits and benefits:

- $120 annual credit ($10 per month) on Uber or Uber Eats

- $120 dining credit ($10 per month) with select merchants (also usable at Boxed.com)

- $100 onsite credit when you book a qualifying stay via The Hotel Collection

- No Foreign Transaction Fees

- Baggage, Car Rental Loss and Damage Insurance

- Purchase Protection and Extended Warranty

The Pundit’s Mantra

If you’re eligible and looking to get the Amex Gold Card, then the 75,000 points welcome bonus is a great offer to take advantage of. Also, compared to the usual time frame, Amex is offering a total of 6 months to meet the minimum spend in order to get the welcome bonus on this card.

Additionally, Amex is also running some fantastic offers on their co-branded Hilton cards as well, giving you the opportunity to earn up to 150,000 points and $150 in statement credits.

___________________________________________________________________________________________________________________

Never miss out on the deals, analysis, news and travel industry trends. Like us on Facebook, follow us on Instagram and Twitter and get the latest content!

___________________________________________________________________________________________________________________

Disclosure: The Points Pundit receives NO compensation from credit card affiliate partnerships. Support the blog by applying for a card through my personal referral links. This article is meant for information purposes only and doesn’t constitute personal finance, health or investment advice. Please consult a licensed professional for advice pertaining to your situation.

Claim Free $200+ Blogging Bonus