Many people aren’t aware about the additional benefits that their credit cards may already be offering. We love to write about the best credit card welcome bonuses, but often tend to miss out on other card features which could be really valuable. One such benefit is the Extended Warranty benefit. For Instance, this benefit saved me at least $618 and potentially even more in terms of work hours lost and the headache of not having a functioning laptop while traveling internationally.

Extended Warranty

In late 2018, I was on a business/leisure trip to India, Singapore and Sri Lanka. While I was in India, I woke up, had my customary cup of tea in the morning and started my laptop to catch up on things. The only problem was that the laptop wouldn’t start! I tried multiple tricks and hacks, but to no avail. I was stuck with a dead laptop while on the road.

Next Steps

After overcoming the sudden initial melancholy of a dead laptop, I quickly realized that my credit card may cover any cost of repair. I had purchased the laptop using my Amex Gold Card. I checked the purchase date in order to verify whether I was eligible for the benefit and was pleased to know that my purchase qualified.

Extended Warranty by American Express

The Extended Warranty benefit by American Express extends the existing warranty of your purchase by up to 1 more year (2 years for purchases prior to January 1, 2020) in addition to the original manufacturer’s warranty. In order to use this benefit, you need to simply purchase the item by using your eligible American Express card. This benefit applies to warranties that are of a period of 5 years or less. Primary cardholders as well as authorized users can use this benefit.

Eligible Purchases

Extended Warranty kicks in once the original manufacturer’s warranty expires. As per the FAQ on Amex’s website, the following items are not eligible for coverage: “items with physical damage, damage as a result of natural disaster, software, motorized devices and vehicles and their parts.

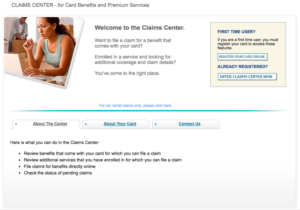

FILING A CLAIM

I filed a claim on the Amex website and completed all the relevant details. Moreover, you can also track the status of your claim online once you file it.

Claim Assessment

After filing the claim online, Amex asked me to complete and send a repair estimate form. I headed over to the nearest authorized Apple retailer in Mumbai, India and got the details updated. After assessing the issue with the laptop, the Apple affiliate determined that it would cost me $618 to repair the laptop. I faxed the completed form back to American Express immediately.

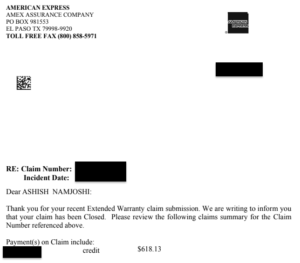

Claim Outcome

To my surprise, Amex approved my Extended Warranty claim in just two business days! They issued a refund to the tune of $618 to my card as a statement credit.

THE PUNDIT’S MANTRA

If you’re not making purchases with the right credit card, you may be leaving money on the table! Things can always go wrong given the number of electronic devices we use or carry on a daily basis. I’ve used the extended warranty and purchase protection benefits a few times. I’ve been impressed with the speed and the manner in which Amex handles these insurance claims.

The best part about this claim was the fact that it worked globally. I’d purchased the laptop using my American Express Gold Card in the US. My laptop stopped working while was traveling and while I was outside the US. I was impressed by how quickly Amex processed the claim and worked with the Apple affiliate in India to get the repair estimate verified.

Currently, you can earn a welcome bonus of 60,000 Membership Rewards points and a ton of other benefits and credits when you sign up for the Amex Gold Card. Read this post for a complete review.

___________________________________________________________________________________________________________________

You can buy Hilton Honors points currently with a 100% bonus. What’s better? You can buy up to 320,000 points in total, at a price of just 0.5 cents per point. This limited time offer ends on December 31st.

Buy Hilton Points with a 100% Bonus

___________________________________________________________________________________________________________________

Disclosure: Our Advertising partners may pay us a small commission if you click on some of the links in this blog post, at no extra cost to you. The Points Pundit receives NO compensation from credit card affiliate partnerships. Support the blog by applying for a card through my personal referral links. This article is meant for information purposes only and doesn’t constitute personal finance, health or investment advice. Please consult a licensed professional for advice pertaining to your situation.

___________________________________________________________________________________________________________________

Never miss out on the deals, analysis, news and travel industry trends. Like us on Facebook, follow us on Instagram and Twitter and get the latest content!