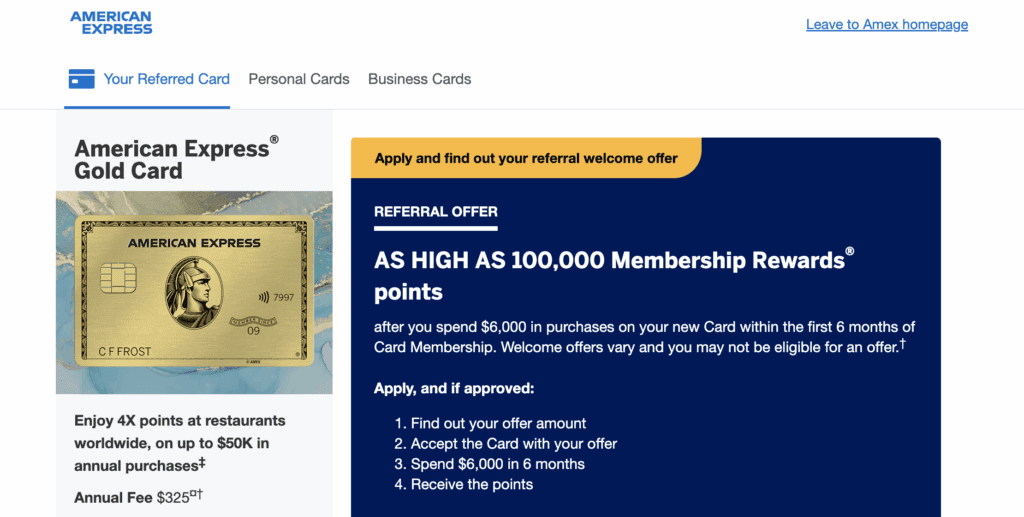

From time to time, American Express runs increased welcome offers through the card issuer’s referral program made available to select cardholders. Right now is one of those times.

If you apply for the American Express® Gold Card using a referral link, you may be eligible for a welcome offer as high as 100,000 Membership Rewards® points after qualifying spend. For context, the typical welcome offer for the Gold Card is around 60,000 to 75,000 points. If you’re selected for the 100,000 bonus point offer, this current elevated referral offer ends up substantially higher than the baseline offers the card usually offers new applicants.

However, there are a few important caveats up front:

- The offer is not guaranteed. American Express shows you your exact welcome offer during the application process, but before you accept the card.

- Not all applicants will see the maximum 100,000-point offer.

- These referral offers are time-limited, but American Express does not publish a firm end date.

With that context out of the way, let’s put the elevated welcome offer aside for a moment and focus on whether the Amex Gold Card actually makes sense.

The American Express® Gold Card (TL;DR)

- Best for: People who spend heavily on dining and U.S. supermarkets and will actually use monthly credits.

- Not ideal for: Costco/Walmart-heavy shoppers or anyone who dislikes “coupon-style” monthly statement credits.

- Welcome offer: Up to 100,000 Membership Rewards® points, but the offer varies by applicant and is not guaranteed.

- Annual fee: $325. You can offset a meaningful portion of it if you use the Uber and dining credits.

- Bottom line: A strong everyday earning card for the right spender with a welcome bonus of up to 100,000 Membership Rewards® points.

What You Need to Know About The American Express Gold Card

Despite a name that evokes luxury, the American Express Gold Card ($325 annual fee) is not meant to serve as a catch-all premium rewards credit card. It’s actually American Express’ mid-tier rewards card. The card is positioned above the Green Card ($150 annual fee) and below The Platinum Card ($895 annual fee). Positioned between these two cards, the Gold Card offers upgraded benefits over the Green Card but lacks the premium benefits offered by The Platinum Card.

At its core, it’s a solid everyday card that earns bonus Membership Rewards points in two key categories: supermarkets and restaurants.

Up to 100,000 Points: Select new American Express Gold Card applicants may see a welcome offer of up to 100,000 Membership Rewards® points after spending $6,000 on eligible purchases within the first six months of card membership. Your exact offer is shown during the application process before you accept the card.

Learn more about this offer and the Gold Card here. (Actual welcome bonus offer will vary. Terms and conditions apply. Gold Card Annual Fee: $325)

How You Earn Points with The Gold Card

The card’s bonus earning rate at supermarkets and restaurants is the main reason I’ve kept this card in my wallet. However, it also earns a modest bonus on travel booked directly through AmexTravel.

Here’s how the card earns American Express Membership Rewards points:

| Category | Points per $1 Spent | Bonus Category Conditions | Bonus Category Limits |

|---|---|---|---|

| Restaurants Worldwide | 4x | Bonus earned on the first $50,000 of eligible purchases | |

| U.S. Supermarkets | 4x | "Supermarkets" excludes superstores and wholesale clubs among others | Bonus earned on the first $25,000 of eligible purchases |

| Airfare | 3x | Must be booked through AmexTravel | |

| Prepaid Travel | 2x | Includes prepaid hotels, car rentals, and cruise bookings booked through AmexTravel | |

| All Other Purchases | 1x |

If you’re someone constantly dining out at restaurants or you spend a fair amount on groceries at supermarkets (this excludes wholesale clubs like Costco), the 4x bonus points on these purchases can add up quickly. Here are a few examples of how many Membership Rewards points you’d earn in these bonus categories:

| Supermarkets Monthly Spend | Restaurants Monthly Spend | Points Earned in a Year | Note(s) |

|---|---|---|---|

| $500 | $200 | 33,600 | Average amount spent by Americans for both categories |

| $750 | $300 | 50,400 | |

| $1,000 | $500 | 72,000 | |

| $2,080 | $4,165 | 299,760 | Maximum monthly spend before you hit the bonus earning caps |

If you’re also someone willing to put in a few minutes each month to review and add the card’s Amex Offers and you manage to use the statement credits consistently, the Gold Card may be a good fit. On the other hand, if you don’t eat out regularly, do most of your shopping at stores like Walmart or Costco, and you’re not interested in statement credits, you’re probably not going to get much value from the card.

With an annual fee of $325, the bonus points you earn in the card’s core categories may be enough to help justify the fee. The card also includes a handful of practical credits and perks.

American Express Gold Card Benefits

As previously mentioned, the Gold Card is not designed to compete in the same league as The Platinum Card or Chase Sapphire Reserve. So, cardholder benefits do not include things like lounge access, perks at Fine Hotels & Resorts, or Marriott Bonvoy Gold status. Still, there are a few noteworthy and practical benefits offered by the Gold Card:

- $120 Uber Cash annually: Cardholders who add their Gold Card to their Uber account receive $10 in Uber Cash each month. You can use this for rides or Uber Eats orders in the U.S. when you select your Gold Card for the transaction.

- $84 Dunkin’ credit: Earn up to $7 in monthly statement credits for eligible purchases at Dunkin’ locations in the U.S. (Enrollment required.)

- $100 Resy credit: Receive up to $50 in statement credits semi-annually when you pay with your Gold Card at eligible U.S. Resy restaurants or for other eligible purchases with Resy.

- $120 dining credit: Receive up to $10 in statement credits each month when you use your Gold Card at participating dining partners.

If you haven’t noticed by now, the American Express Gold Card is heavily oriented toward dining value. There is one additional non-dining-related perk worth calling out:

- $100 Hotel Collection credit: When you book two or more nights at a The Hotel Collection property through AmexTravel, you can receive a $100 statement credit toward eligible on-property charges at over 1,300 properties.

Why I Keep The Amex Gold Card in My Wallet

The American Express Gold Card was one of my first credit cards, dating back to when I was still in college. Since then, it has stayed in my wallet for one simple reason: it earns points where I already spend money.

Most people are more likely to rack up points at the neighborhood supermarket or restaurants than with airlines and hotels. That’s where the Gold Card does its best work. Over time, the points from routine spending add up surprisingly fast.

Read More: What Is It Like to Rent an Electric Car?

Using Your American Express Membership Rewards

Membership Rewards points are valuable primarily because you can transfer them to airline and hotel partners. You can redeem points directly with American Express, but you’ll usually get far more value by transferring them to travel partners and booking awards strategically.

American Express has 20 transfer partners. Here are a few of the most noteworthy:

- Air Canada Aeroplan

- Air France-KLM Flying Blue

- Avianca LifeMiles

- Delta SkyMiles

- Emirates Skywards

- Hilton Honors

- JetBlue TrueBlue

- Marriott Bonvoy

- Singapore Airlines KrisFlyer

- The British Airways Club

- Virgin Atlantic Flying Club

I generally recommend transferring points, especially when Amex offers transfer bonuses to select partners. You can also redeem points via AmexTravel for flights, rental cars, and hotels. As a last resort, you can redeem points for statement credit, though that typically delivers weaker value.

If you’re interested in some of the best uses of American Express Membership Rewards, check out this guide from AwardWallet.

Related: What It’s Like To Fly Qatar Airways QSuites to Sydney

The American Express Gold Card Referral Bonus

Unlike some welcome offers you see elsewhere, referral-based offers can be a slightly different experience. As already noted, 100,000 points is the maximum bonus new applicants can receive, but not everyone will see it.

Importantly, American Express shows you your exact welcome offer during the application flow before you accept the card, which means you can choose to continue or stop based on what you’re offered.

The process generally works like this:

- Use this referral link (or another link in this post) to view the Gold Card and start an application.

- Complete and submit your application.

- If you receive conditional approval, you will be shown your welcome offer.

- You can then accept or decline and end the application process.

The terms and conditions for this referral offer

Currently, the welcome offer requires $6,000 in purchases on your new card within the first six months of card membership. It’s also worth noting that some applicants may not be eligible for a welcome offer based on American Express’ eligibility rules.

American Express is clear that you may not be eligible for a welcome offer if you currently have or have previously held certain cards. Always review the terms shown during your application. You can review full offer terms directly on the American Express website during the application process and by clicking this link.

Finally, keep in mind the American Express Gold Card has an annual fee of $325. To earn any welcome bonus, you must keep the account open and pay the annual fee once billed.

Final Thoughts

The American Express® Gold Card is not designed to compete on prestige or premium travel perks, and that is precisely why it works well for a specific type of cardholder. It is built around consistent, everyday spending rather than benefits that many people only use a few times per year.

For people who regularly spend on dining and groceries, the Gold Card can generate a meaningful sum of Membership Rewards points without changing spending habits or tracking complicated bonus categories. Over time, that steady earning can outweigh the appeal of cards that focus primarily on travel perks.

The current referral offers, which may show welcome bonuses of up to 100,000 points, make the Gold Card more compelling than usual. That said, the card only makes sense if it fits naturally into how you already spend money. A strong welcome offer should be viewed as an added benefit, not the sole reason to apply.