American Express offers a ton of great benefits on many of their premium credit card products. However, not all benefits are created the same. The airline fee credit benefit, on the face of it, sounds like a simple credit that you’d get when you book a flight ticket. However, Amex only offers these credits on what it deems as incidental purchases on qualifying US based airlines. As usual, at the start of the new year, I took stock of which cards are there in my wallet and decided to use up the credits right out of the gate.

Amex Platinum Card: Airline Fee Credit Benefit

At the moment, I have one Platinum card from American Express, which is the Charles Schwab version. So, I only had one credit card on which I needed to take care of the airline fee credit. However, the Airline Fee credit benefit is also offered by American Express on the Business Platinum Card. For the Amex Platinum Card and the Business Platinum Card, cardholders enjoy a maximum of $200 during each calendar year on qualifying purchases.

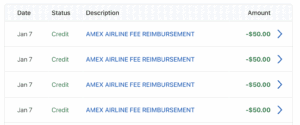

I looked up data points on Flyertalk and decided to once again choose United airlines as my option for these credits. After making United as my airline selection, I then waited for a couple of days. I started loading my United Travel Bank in increments of $50, buying four increments of $50 each. Here’s the timeline.

Timeline

Date on which I selected United Airlines: January 1, 2026

Date on which I made the purchases: January 4, 2026

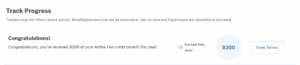

Once you make the purchase, Amex’s benefits tracker usually moves and shows that you’ve utilized the benefit. One the benefit tracker moves, it’s usually a sign that your credits will post very soon.

Date on which the benefits tracker moved: January 6, 2026

Date on which the credit posted to the account: January 7, 2026

THE PUNDIT’S MANTRA

Over the last five years or so, this has been a lucrative method for using up my airline fee credit benefit. Things can always change, so I always make a point to set a reminder early in the year to take care of all my airline fee credits. It gives me the option to use these funds to buy flight tickets in the future.

If you look around, there are creative ways of using this benefits with different airlines, in case you don’t have travel coming up on Amex’s partner airlines immediately.

How do you plan to use the airline fee credit benefit in 2026? Tell us in the comments section.

___________________________________________________________________________________________________________________

___________________________________________________________________________________________________________________

Credit Card Offers

American Express Business Credit Cards

- Earn 200,000 Membership Rewards points with the Business Platinum Card

- Earn 100,000 Membership Rewards points with the Business Gold Card by American Express

Chase Sapphire Cards

Im getting very concern about the amount of times some does a write up on how to hack this credit. At this point consider me a gatekeeper because there’s a write up every month on this hack for at least the last three-years.

AMEX is gonna nuff it soon enough simply because it’s in their face every month.

Thank me later.

Lu