Disclosure: I receive NO compensation from credit card affiliate partnerships. Support the blog by applying for a card through my personal referral links

The premium card space continues to heat up. Just a few days back, I wrote about why I thought that the Chase Sapphire Reserve was still leading the pack. Now, Chase has launched another premium credit card. The United Club Infinite card by Chase has a launched with a massive 100,000 miles welcome bonus!

Welcome Bonus – 100,000 United Miles!

With this welcome bonus, you can earn 100,000 bonus United Miles after you spend $5,000 in the first three months after approval. The annual fee for this card is a whopping $525! The limited time welcome bonus offer ends on May 18, 2020.

However, this card is available to you if you do not have any United Club card and have not received a welcome bonus for any United Club card in the past 24 months. Please note, in addition to this, Chase 5/24 should also apply to this card as it does to most Chase cards these days.

Earning Categories

With this card you can earn bonus United miles in the following categories:

- 4 miles/$ spent on United Purchases

- 2 miles/$ spent on dining at restaurants

- 2 miles/$ spent on all other travel (including local transit, rideshare and tolls)

- 1 mile/$ spent on all other purchases

Additional Benefits

Some of the other benefits on this card are pretty similar to the United Club card:

- United Club Membership – However, if you already have United Club membership, you can be reimbursed for the unused portion once Chase approves you for this card.

- No blackout dates – this doesn’t make much sense to me as United now charges you extra miles instead of close in booking fees. So, you pay extra miles even if you have elite status.

- 1st and 2nd checked bag is free for the primary cardholder and one companion

- $100 credit for Global Entry & TSA Pre-Check

- 25% back on United flight purchases

- No foreign transaction fees

- Complimentary Hertz Gold Plus Rewards President’s Circle status

- Luxury Hotels & Rewards Collection

- Visa Infinite Concierge Services

Other Benefits

In addition to these benefits, you’ll also get other benefits that are standard with most Chase premium cards.

- Trip Cancellation / Trip Interruption Insurance

- Baggage Delay Insurance

- Lost Luggage Reimbursement

- Trip Delay Reimbursement

- Auto Rental Collision Damage Waiver

- Purchase Protection

- Return Protection

- Extended Warranty Protection

Who should get this card?

Firstly, you must consider whether you’re eligible to apply, given how stringent Chase’s application rules are. Secondly, if you frequent airports that have a United Club and you fly United regularly, then this card can be a really good proposition for you.

Other than that, I don’t see this card as that great an option for earning United Miles. The Chase Sapphire Reserve has a $550 annual fee and earns 3x Ultimate Rewards Points on travel, which are flexible and you can always transfer to United at a 1:1 ratio. Similarly, the Ink Business Preferred also helps you earn 3x points per dollar spent on travel, telecommunication and office supply store purchases. As opposed to the Sapphire Reserve, the Ink Preferred only has a $95 and a 80,000 Ultimate Rewards points welcome bonus.

Other Card Options

Given United’s recent moves, most frequent flyers have been irked by their insensitive response with regards to cancellations and change policies in light of the Coronavirus outbreak. If you don’t fly United frequently, you have other Chase card options that you can use. You’ll earn Ultimate Rewards points with them, which you can transfer to United or any of Chase’s transfer partners like Hyatt at a 1:1 ratio.

| Card Name | Welcome Bonus | Min. Points Earning | Max. Points Earning | Annual Fee |

| Chase Ink Business Preferred | 80,000 UR Points | 1x | 3x | 95 |

| Chase Ink Business Unlimited | 50,000 UR Points | 1.5x | 1.5x | 0 |

| Ink Business Cash | 50,000 UR Points | 1x | 5x | 0 |

| Chase Freedom | 20,000 UR Points | 1x | 5x | 0 |

| Chase Freedom Unlimited | 20,000 UR Points | 1.5x | 1.5x | 0 |

| Chase Sapphire Preferred | 60,000 UR points | 1x | 2x | 95 |

| Chase Sapphire Reserve | 50,000 UR Points | 1x | 3x | 550 |

The Pundit’s Mantra

If you’re eligible, this welcome bonus can be an amazing way to boost your United mileage earning. Given that I don’t fly United and I’ve made my opinion crystal clear, I intend to pass this offer and instead focus on boosting my Ultimate Rewards points balance, by maximizing everyday spend.

If you still want a co-branded United card, you still have other options like the MileagePlus card, which has a lower welcome bonus currently but only has a $99 annual fee.

Do you intend to sign up for this 100,000 mile welcome bonus? What do you think about Chase’s newest premium credit card? Let us know in the comments section.

___________________________________________________________________________________________________________________

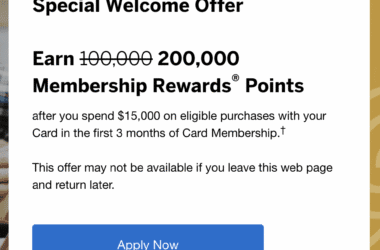

This card is a personal favorite of The Points Pundit. A Welcome bonus of 80,000 Ultimate Rewards points! with the Ink Business Preferred Card by Chase (Chase’s 5/24 rule applies to this card)

Never miss out on the best miles/points deals. Like us on Facebook, follow us on Instagram and Twitter to keep getting the latest content!